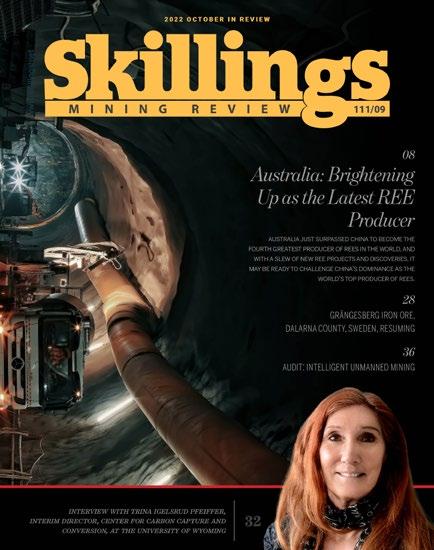

Australia: Brightening Up as the Latest REE Producer

just surpassed china to become the fourth greatest producer of rees in the world, and

a slew of new ree projects and discoveries, it may be ready to challenge china's dominance as the world's top

of rees.

2022 OCTOBER IN REVIEW 111/10 32 interview with trina igelsrud pfeiffer, interim director, center for carbon capture and conversion, at the university of wyoming grängesberg iron ore, dalarna county, sweden, resuming audit: intelligent unmanned mining 28 36 08 australia

with

producer

2 | SKILLINGS MINING REVIEW October 2022 BIG RESULTS SMALL TEAM Optiro is a resource consulting and advisory group. Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software. In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results. +$15 BILLION DEALS/ VALUATIONS >780 MILLION oz Au RESOURCE AUDITS >64 MILLION oz Au RESOURCE ESTIMATES >3,000 CLIENTS +2,000 PEOPLE TRAINED 24 COMMODITIES 53 COUNTRIES >4,300 MILLION lb NICKEL >5,100 MILLION lb COPPER+5 IRON ORE BILLION TONNES www.optiro.com contact@optiro.com +61 8 9215 0000

THE LEAD

08 Australia: Brightening Up as the Latest Rare Earth Elements Producer

MINING EQUIPMENT

22 Novel Self-Propelled Bale Chaser: Contractor Work

MINING FINANCE

14 Insider Buys Anglo American plc Shares Worth £173.28

PROFILES IN MINING

32 Interview with Trina Igelsrud Pfeiffer, Interim Director, Center for Carbon Capture and Conver sion, at the University of Wyoming

SPECIAL FOCUS

16 Mining Technology Inculca tion: Australia a Trendsetter!

29 Grängesberg Iron Ore, Dalarna County, Sweden Resuming

36 Audit: Intelligent Unmanned Mining

SURFACE MINING

05 Agnico Eagle’s Fosterville Gold Mine: Big Preparations

06 Iron-Ore Processing: New Gen Compact Pelletizing

06 Mantos Blancos and Manot verde mines in Chile

06 Metso Outotec Expands: Pennsylvania

15 Shaft sinking innovations, safer workplace by 2040

19 Slam Exploration Mobilizing to Drill Gold Veins at Menneval

31 Vale Unveils the Next Sus tainable Sand Operation

STATISTICS

26 Great Lakes Iron Ore Trade Down in August

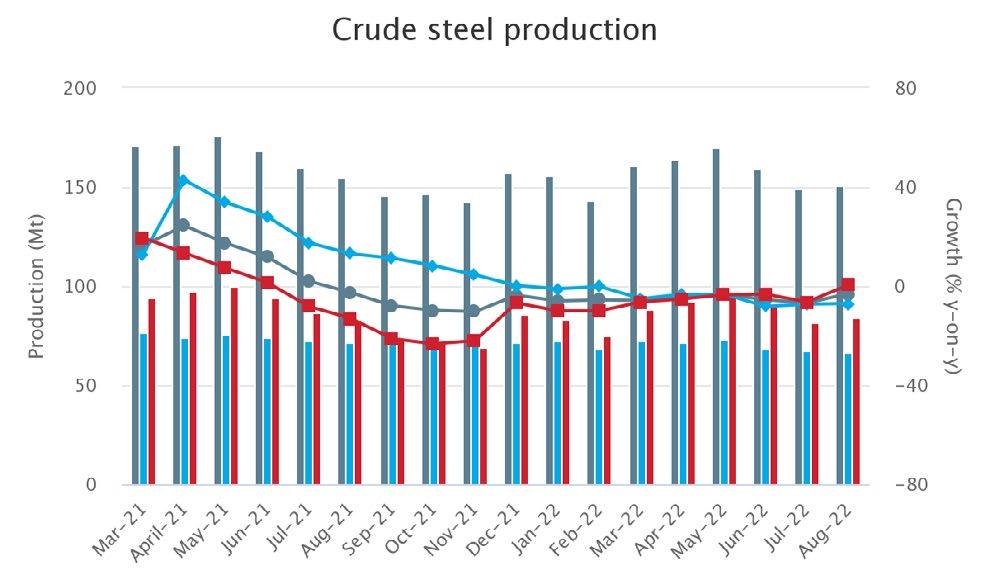

46 August 2022 crude steel production

47 Crude steel production December 2020

UNDERGROUND MINING

14 India: Sandvik Mining Automa tion Learning Center Opened

20 Viscount Mining TITAN MT Survey Confirms Conductive Anom aly at Silver Cliff, Colorado

39 Iron & Steel: The Route Starts!

40 Awards Ceremony Recogni tion: Longwall Automation from Anglo American’s Milestones

44 Phase III RC Drilling Results Confirm Southern Extension of Christmas Gift Prospect Bur racoppin Gold Project, WA

www.skillings.net | 3

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US Funds 1st Class Mail

Skillings Mining Review of CFX Network

comprehensive information on global mining,

industry issues via Skillings Mining

Americas, Global Skillings

and

OUTSIDE OF UNITED STATES

$250 US Monthly for 7 - 21 day delivery $335 US Monthly for Air Mail Service

All

SKILLINGS MINING REVIEW NEWS ROOM

Digital Monthly Magazine

SMR Americas Monday Global Skillings Wednesday Skillings Equipment Gear Friday

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS:

For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net

Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

www.skillings.net

SKILLINGS MINING REVIEW

(ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284

Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284.

Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to: Skillings mining review, 350 W. Venice Ave. #1184 Venice, Florida 34284.

Phone: (888) 444 7854 x 4. Fax: (888) 261-6014. Email: Advertising@Skillings.net.

SUBSCRIPTIONS

funds are monthly $4.95 USD per month publisher CHARLES PITTS chas.pitts@skillings.net managing editor SAKSHI SINGLA sakshi.singla@skillings.net editor-in-chief JOHN EDWARD john.edward@skillings.net creative director MO SHINE mo.shine@skillings.net contributing editors ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE media production STANISLAV PAVLISHIN media.team@cfxnetwork.com media administrator SALINI KRISHNAN salini.krishnan@cfxnetwork.com director of sales & marketing CHRISTINE MARIE advertising@skillings.net profiles in mining mining.profiles@skillings.net general contact information info@cfxnetwork.com 2022 OCTOBER VOL.111. NO.10

LLC, publishes

iron ore markets

critical

Review Monthly Magazine and weekly. SMR

and Skilling Equipment Gear newsletters.

4 | SKILLINGS MINING REVIEW October 2022

Agnico Eagle’s Fosterville Gold Mine:

Big Preparations

Agnico EAglE will invEstigAtE thE AdvAntAgEs of bAttEry ElEc tric underground technology after receiving a planned Sandvik LH518B underground loader to be tested at its Fosterville gold mine in Victoria, Australia. This research will take place in the second half of 2022.

The Fosterville operation, 20 kilometers from Bendigo, will receive the new Sandvik loader, making it the second mine in Australia to do so (the first being Gold Fields' St Ives operation in Western Australia).

However, Fosterville will be the first mine on Australia's East Coast. The LH518B produces zero subterranean exhaust emissions and releases substantially less heat than its diesel

competitors because of its cutting-edge lithium-iron-phosphate battery technology.

At the IMARC Online conference in November 2020, Rob McLean—at the time Fosterville's Chief Mining Engineer— announced intentions for the operation to test the Sandvik LH518B.

He said that the experiment, which was ini tially scheduled for 2021, was a component of the firm's vision to "have a fully electric mine," with the nearest objectives being the elimination of diesel emissions and a decrease in heat at the facility.

www.skillings.net | 5

Metso Outotec

Expands: Pennsylvania

According to Metso Outotec, all its mineral testing services are now provided out of a single 5,500 m2 facility in York, Pennsylvania. The Test Center's capabilities will be continuously improved to support the global mining sector by addressing the entire minerals value chain.

"Year 2021 has seen a huge increase in testing activity volume. We can conduct a lot more linked and pilot-scale testing if we have more room and activities in one location. The test centre in York focuses on grinding R&D in close collaboration with our headquarters in York, as well as standard and custom grind ing tests in both laboratory and pilot size. We can now do tests for calcining, induration, and drying thanks to the addition of pyro testing capabilities. We are now developing new tools for bench and lab-scale filtra tion and thickening experiments”, says Alan Boylston, director of process engineering at Metso Outotec.

Iron-Ore Processing: New Gen Compact Pelletizing

MEtso outotEc lAunchEd its “coMpAct sizEd pEllEt plAnt” after optimizing its current induration technology.

T he facility is built on the cutting-edge design of the company's larger (4-m wide) product range and is based on

a 3-m wide indurating machine. Similar plant performance and product quality are provided by the new compact plant as is done by the larger-size plants. 189 m2 (1.21.5 million metric tons per year (m.t./yr)), 288 m2 (1.7-2.3 million m.t./yr), and 315 m2 (2.0-2.6 million m.t./yr) are the three standard sizes (capacities) that are available.

Mantos Blancos and Manotverde mines in Chile

At its chilEAn fAcilitiEs in MAntos blAncos And MAntovErdE,

Capstone Copper Corp. claims it has committed to the Copper Mark. The Copper Mark is a system of assurance designed to support ethical production methods and show the industry's dedication to the UN Sustainable Development Goals.

T he 32 responsible production requirements for the Copper Mark, including environmental management, greenhouse gas emissions, human rights, community health, safety and development, and governance, will

be evaluated and independently validated for Mantos Blancos and Mantoverde within a year. "I am delighted to share that our Mantos Blancos and Mantoverde operations have joined the Copper Mark framework, underlining our commitment to consistently pursue best practises based on worldwide standards for responsible mining," said John MacKenzie, CEO of Capstone.

It is our duty to ensure that we deliver copper in the most sustainable way possible because it is crucial to a low-carbon future.

6 | SKILLINGS MINING REVIEW October 2022 SURFACE MINING

ME Elecmetal Comminution Solutions Innovative Solutions - Proven Performance www.me-elecmetal.com ME Elecmetal o ers more than mill liners — we o er innovation, support, custom designs and valuable tools to develop a total comminution solution speci c to your needs. We are on the ground with our customers — setting common goals and providing timely responses based on e ective collaboration. Drawing on over 100 years of experience and advanced technologies, we will help you optimize processes, extend the lifespan of wear parts, reduce operational risks and increase pro tability. Innovative Mill Lining Solutions for SAG, AG, Ball, Tower & Rod Mills • Steel • Rubber • Composite Premium Quality Forged Steel Grinding Media for SAG, Ball & Rod Mills • ME Super SAG®: 4.0” to 6.25” • ME Ultra Grind®: 1.5” to 4.0” • ME Ultra Grind®II: 2.0“ to 4.0” • ME Performa®: 7/8” to 1.5” Wear Components for Primary, Secondary & Tertiary Crushers • Gyratory Crushers • Jaw Crushers • Cone Crushers

Earth Elements

You would have probably heard about China's supremacy in producing vital rare earth elements (REEs). Australia just surpassed China to become the fourth greatest producer of REEs in the world, and with a slew of new REE projects and discoveries, it may be ready to challenge China's dominance as the world's top producer of REEs.

Producer 8 | SKILLINGS MINING REVIEW September 2022 THE LEAD image © Jacob Kepler/Bloomberg

www.skillings.net | 9

Unique Earths

The chemically related elements Yttrium (Y) and Scandium (Sc), which are located at the bottom of the periodic table, are frequently grouped in the group of elements known as rare earths. The most frequent element, cerium, is nearly as common in the earth's crust as copper, whilst the rarest element, lutetium, is more than 80 times less abundant.

Despite their names, these elements are not all equally uncommon. Compared to heavy rare earths, light rare earths (LREE) are much more prevalent and less expensive (HREE).

Many high-tech products, like the displays on smartphones, the magnets in wind turbines and electric vehicles, and missile guidance systems, depend on REEs. Due to the rarity of the deposits and the expensive, time-con suming, and frequently environmentally

damaging ore processing, it has been difficult to develop a reliable supply of these strate gically and economically important metals.

Over 80% of the world's supply was gen erated in China over the last two decades. Because of China's ability to exploit REE supplies as geopolitical leverage in trade disputes due to its near-monopoly, efforts to diversify production have increased.

Reserves of Rare Earth

Almost all known REE occurrences are connected to uncommon forms of magmatism. The majority of the world's resources are contained in, or closely related to, carbonatites or alkaline igneous rocks, as well as heavy mineral sands produced by the erosion of these rocks. Mining faces difficulties as a result of this lack of diversity.

Most of the REEs in alkaline rocks are found in silicate minerals, which are difficult to impossible to commercially process with existing technology. In contrast, carbon atite deposits, which are more economically viable, are rich in LREEs but very poor in the more desirable HREEs. The majority of the world's HREEs come from deposits of ionic-absorption clay that are created when granites rich in REEs weather in tropical regions. These deposits, which vir tually exclusively occur in southeast Asia (mostly China), contain only tiny amounts of resources that are quickly running out. In the long run, there are lots of LREEs available, but HREEs may not be as plentiful.

Tol Weld

With proven and probable reserves of 19.7 Mt at 8.6% total rare earth oxides (TREO) and measured, indicated, and inferred resources of 55.4 Mt at 5.4% TREO, Mt Weld, Australia, is one of the largest and highest-grade REE deposits in the world. Mine should last for at least 25 years.

The project also contains the undeveloped Duncan (REE), Crown (niobium, tantalum, titanium, REE, zirconium), and Swan (phos phate) resources, albeit only the Central Lanthanide Deposit is now mined. The Lynas Rare Earths Corp. is the project's owner.

The 66 Kt/year of REE concentrate that Mt Weld generates is sent to Lynas's process ing facility in Malaysia for processing. Due to the creation of radioactive waste, this plant has generated controversy, yet, the Malaysian government recently renewed its operational license.

Although this will be an addition to existing offshore processing rather than a replace ment, Lynas is currently building a new processing facility in Australia.

Mt. Weld is a rare, more than 50% carbon ate-bearing igneous rock called carbonatite that is two billion years old and has under

Due to the rarity of the deposits and the expensive, time-consuming, and frequently environmentally damaging ore processing, it has been difficult to develop a reliable supply of the strategically and economically important metals.

Olympic Dam, South Australia.

LEAD

10 | SKILLINGS MINING REVIEW October 2022 THE

gone extensive weathering. By disintegrating the once-solid ore, this weathering has improved the carbonatite, which was already rich in REEs, into one of the highest-grade deposits in the world and made the deposit easier to mine. Although some HREEs are found, Mt. Weld produces mostly LREE, like the majority of carbonatites.

Olympic Dam

The largest copper, gold, silver, and uranium mines in the world are located in Olympic Dam, South Australia. Olympic Dam contains low-grade REE mineralization (mostly LREE), like many other Iron-Oxide-Copper-Gold (IOCG) deposits. This makes Olympic Dam, with resources of about 2000 Mt at 0.5% REO, one of the greatest REE deposits in the world due to the massive magnitude of the deposit. BHP Billiton is the owner of the project.

At Olympic Dam, REEs are not yet recov ered. There have been numerous ideas to recover REEs as a byproduct, but since most of them are the low-value LREEs lanthanum and cerium, it would require a substantial investment in new processing facilities and is unlikely to happen very soon.

Eneabba

Approximately $1.5 billion REE refinery will be built at Iluka Resources' Eneabba project in Western Australia as part of the company's goal to expand into the REE industry. Iluka Resources has previously largely produced mineral sands.

By 2025, the refinery is anticipated to pro cess 17.5 kt/year of REO. For construction financing, Iluka has obtained a $1.25 billion loan from the Australian government.

The plant is intended to process feedstocks from other projects. However, it will initially treat Iluka's stockpiles of REE-bearing min eral sands, which have an anticipated lifespan of 10 years. REE sands from Iluka's Wimmera Project in Victoria, Australia, might also be processed at Eneabba.

Yangibana

Hastings Technology Metals obtained a $100 million government loan earlier this year to start working on its $500 million Yangibana Project in Western Australia. Measure, indicated, and inferred resources total 21.67 Mt at 1.17% TREO, with proven and probable reserves at 10.35 Mt at 1.22% TREO.

Neodymium and praseodymium, two of the more sought-after LREEs, will be the mine's primary targets. Hastings has agreements in place to export 6 Kt of REE concentrate annually for processing in China. After Mt. Weld, it would be Australia's second-largest producer of REE.

The majority of the rare earth elements (REEs) are hosted in the mineral monazite, which is present in several narrow iron stone dykes that are 1.3 billion years old and associated with carbonatite.

The Brockman Project in Western Australia, owned by Hastings as well, contains 52 Mt of 0.22% TREO (85% of which are HREEs), along with 0.39% niobium oxide and 0.95% zirconium oxide.

Dubbo

At the Dubbo Project in New South Wales, operated by Australian Strategic Metals (ASM), there are proven reserves of 18.9 Mt at 0.871% TREO, plus 1.85% zirconium oxide, 0.04% hafnium oxide, 0.440% niobium oxide, and 0.029% tantalum oxide, as well as measured and inferred resources of 75.18 Mt at 0.88% TREO, plus 1.89% zirconium

Illustration of how the Wolverine Deposit formed.

Illustration of how the Wolverine Deposit formed.

www.skillings.net | 11

oxide, 0.04% haf It is now a premier rare metals deposit in the world. The mine life is anticipated to be at least 20 years, and the project is getting ready to start development. It will produce 1 Mt/year from an open pit. In South Korea, a processing facility is anticipated to be built.

Trachyte, a subvolcanic alkaline rock, makes up the deposit's sill. Although the silicates, carbonates, and oxides that make up ore minerals are varied, ASM thinks the ore can still be treated rather simply.

Blacks Range

In recent years, a number of REE deposits have been found in northern Australia's Browns Range. The Wolverine deposit, owned by Northern Minerals, is the largest of them and has resources of 4.97 Mt at 0.86% total REEs. While generally not spectacular, Wolverine's high percentage (89%!) of HREEs + Y makes him a unique and fascinating find.

In order to extend the potential mine life, Northern Minerals has finished a pilot processing facility and is now looking for additional near-surface resources at Wolver

ine and other deposits. Like other deposits in the region, Wolverine's ore is composed of quartz-xenotime veins and breccias that are 1.65–1.60 billion years old and are located in sharply dipping fault zones.

The deposits in the Browns Range appear to be of a brand-new type called uncon formity-related REE deposits. These REE deposits, unlike the majority of them, are hydrothermal in origin and have no known connection to magmatic processes. Due to how difficult it is for fluids to carry REEs regularly, hydrothermal REE deposits are extremely infrequent.

In order to leach REEs from metasedimentary rocks, fluids involved in the Browns Range deposits appear to have been exceptionally acidic and rich in chlorine and fluorine. Why these ore-forming fluids are so much higher in HREEs than LREEs is unknown.

Once inside fault systems, these REE-con taining fluids were able to cross the unconformity separating the metamorphic rocks from the underlying sedimentary rocks. Due to interaction with a fluid made of phosphorous from the sandstones above,

this caused ore to deposit. Due to phospho rus' high reactivity with REEs, minerals like monazite and xenotime will form as a result.

The Maw Zone, the only other known analogous deposit, is connected with uncon formity-related uranium (U) deposits in the Athabasca Basin, Canada. Overall, this pro cess is very similar to unconformity-related uranium (U) deposits.

Investor Takeaways: Is Chinese REE Dominance coming to an end?

China continues to dominate the production of REEs worldwide, accounting for 60-80% in 2021. (the uncertainty is due to illegal and undocumented mining). However, this is less than a decade ago when it generated about 95%. On the other side, Australia has increased from 0% to 7% in the same period and could produce up to 30% of the world's REEs in the next years.

With the reopening of the Mountain Pass mine in California, America has also reemerged as a significant producer. It appears that the Chinese government has taken note, as they have been charged with utilizing deceptive marketing practices and disinformation efforts to harm foreign producers.

Since there didn't appear to be many other sources of these rare elements up until recently, the discovery of deposits rich in HREE may prove to be of great significance. It remains to be seen if these unconventional reserves can be successfully developed.

Weld

Despite the fact that some of these Austra lian projects are still years away from going into production, the discovery of so many potentially viable deposits of various types, along with the significant investments made in domestic processing facilities, suggests that Australia's REE mining industry may be in for some exciting times in the future.

Geology of the Mount

Project 12 | SKILLINGS MINING REVIEW October 2022 THE LEAD

HALCOR PRODUCTS

Copper tubes with or without lining or industrial insulation for applications in:

• Drinking water and heating networks

• Underfloor heating and cooling

• Gas and medical distribution networks gases

• Cooling and air conditioning systems

• Solar energy applications

• Various industrial applications

Halcor is the copper tubes division of ElvalHalcor S.A. and together with four more companies form the copper segment of ElvalHalcor S.A. that specializes in the production, processing and marketing of copper and copper alloys products with dynamic commercial presence in the European and global markets. For more than 80 years, Halcor has been offering innovative and added-value solutions that meet contemporary client demands in fields, such as plumbing, HVAC&R, renewable energy, architecture, engineering and industrial production.

The copper segment of ElvalHalcor S.A. is composed of six subsidiaries and seven associates/joint ventures, based in Greece, Belgium, Bulgaria, Romania and Turkey, while it operates a total of five production plants in Greece, Bulgaria and Turkey.

The copper segment of ElvalHalcor S.A. develops and distributes a wide range of products, including copper and copper-al loy rolled and extruded products with Halcor being the sole producer of copper tubes in Greece. High quality in production

is achieved through strict controls applied throughout the production process. With a consistent quality focus, the company implements an ISO 9001:2015 Certified Quality Management System and leverages high technologies and expert staff.

As a result of the Group’s strategic invest ments in research & development, Halcor is recognized as one of the leading copper producers globally, setting new standards in copper processing. The company main tains a consistent focus on quality and

environmental protection and a strong commitment to the principles of sus tainable development. In this context, all production facilities in the Group’s plants leverage advanced technologies to bring in the market innovative products that are energy efficient and environmen tally friendly.

For more information, please visit our web site www.halcor.com

www.skillings.net | 13

India: Sandvik Mining Automation Learning Center Opened

thE sAndvik Mining AutoMAtion lEArning cEntrE (sMAc) wAs established on the campus of IIT Indian School of Mines (ISM) in col laboration with Sandvik Mining and Rock Technology, India, to provide the mining sector with educated and skilled labor for mine automation.

The center was officially opened by Prabhat Kumar, Director General (DG) of the Directorate General of Mines Safety (DGMS), who was highly pleased with the IIT's initiative (ISM). Markus Lundgren, the Sweden embassy's economic and commercial adviser, Prof. Rajiv Shekhar, the director of IIT (ISM), Kiran Acharya, the managing director of Sandik Asia Private Limited, Asoktaru Chattopadhya, the country head and president of Sandvik Rock Processing, Manojit Haldar, Sandvik Mining and Rock Technology India, and Dhiraj Kumar, the deputy director of IIT (ISM), who is also the project director of TEX.

Prof Rajiv Shekhar, Director, IIT (ISM) Dhanbad who also is the chairman, Hub Governing Board, TEXMiN Foundation

Markus Lundgren, Economic and Com mercial Counsellor, Embassy of Sweden in India said ,"the centre is an excellent example of bilateral cooperation between India and Sweden. The main purpose is to produce mining engineers having knowledge of the latest mining technologies that make underground mines more safe as well as automated in future".

DGMS DG Prabhat Kumar, the event's key note guest, stated at the event's opening remarks that the mining industry's primary need is for skilled labor since it provides more effective and safe mining. He applauded IIT (ISM) Dhanbad, India, for taking the ini tiative to open the center to deliver the most outstanding talent and automation in the mining industry.

Insider Buys Anglo American plc Shares Worth

£173.28

Anglo AMEricA n plc insidE r Tony O’Neill acquired six shares of the stock on September 14, 2022 in a deal. The shares were bought for a total of £173.28 ($209.38) i.e. an average price of GBX 2,888 ($34.90) per share.

AAL shares increased in value by GBX 13 ($0.16) thereby reaching GBX 2,828.50 ($34.18). Compared to its usual volume of 3,491,150; the company’s stock had a trading volume of 2,447,067 shares. The compa ny’s fifty-day and 200-day moving average prices were GBP 2,818.05 and GBP 3,355 respectively.

The fifty-two-week low for Anglo American plc is GBP 2,350 ($28.40) and the fifty-twoweek high is GBP 4,996.80 ($60.38). The company has a debt-to-equity ratio of 37.42, a quick ratio of 1.28, a current ratio of 1.90, and a quick ratio of 1.28. The market capi talization for the company is £37.83 billion and the price-to-earnings ratio is 570.87.

Recently, the company announced a divi dend that would be paid on September 23. Shareholders of record on August 18 will be given a $1.24 dividend. This amounts to a 3.71% yield. Presently, the payout ratio for Anglo American plc is 58.27%.

scan the qr code to read the full story on our website

DGMS director general inaugurates Sandvik Mining Automation Learning Centre (SMAC)

14 | SKILLINGS MINING REVIEW October 2022 MINING FINANCE

Shaft sinking innovations, safer workplace by 2040

Lucara Diamond Corporation or Lucara has earned over 120.5m USD in diamond sales for the past six months from the Karowe mine located in Botswana.

They have also decided to start shaft sinking in order to make a transition from open pit to underground operations. This mine has been operating for the past 10 years. The shift will further extend the life of the mine through 2040. “The estimated capital cost of the underground project has been increased from $534m to $547m “to

reflect expected pricing changes following execution of the main sink contract,” Eira Thomas, Karowe CEO said.

He also added that the mine ramp-up is expected in the first quarter of 2026 with full production from the Karowe UGP (under ground project) expected in the second half of

2026. Lucara is expected to spend a total of 110m USD on this shaft sinking project but they will not need to pay any tax for the year 2022 because of Botswana’s pro gressive tax rate computation.

scan the qr code to read the full story on our website

∙ Mineral purchase agreements, leases and options

∙ Land assembly and mineral rights acquisition

∙ Severed mineral registration and title work

∙ Environmental permitting and compliance

fryberger.com

Equipping the mining industry with legal services since 1893.

Paul Kilgore

Paul Loraas

››

››

° MINING & MINERALS LAW °

www.skillings.net | 15

Mining Technology Inculcation: Australia a Trendsetter!

businEss AnAlysts prEdict thAt tEchnology will coMplEtEly transform the mining industry in Australia. According to a 2019 analysis commissioned by the Minerals Council of Australia (MCA), technology advancements will affect more than 77% of jobs in the country's mining sector over the next five years, potentially boosting productivity by up to 23%.

A ustralia's education and training mechanism will require to undergo a change in order to get there, fusing mining expertise with "the newest scientific, technical and trade skills," including data analytics, computers, and change management.

After experiencing a decline from 2009 to 2013, mining productivity has shown favor able trends, with gains primarily attributable to lower capital expenditure (capex) and operational expenditure (opex).

According to a report from McKinsey & Company, 2020, increases in output are

likely to keep the Australian region at the forefront of the adoption of new technologies.

Adoption of new technologies, especially autonomous ones, without taking end-to-end mining throughput into account, is at best difficult and, at worst, indicates a failure of the business. Before implementing a tech nology upgrade, it would seem reasonable to view the "whole mining process" as an engineered system in which all components should be prioritized. However, this has not always been the case.

A notable success story was Rio Tint's Pilbara iron ore mine, which used 80 driverless trucks in 2008 and saw significant pro

16 | SKILLINGS MINING REVIEW October 2022 SURFACE MINING

duction gains. Following suit, BHP Billiton and Suncor did the same, and the presence of Caterpillar, Sandvik, Komatsu, and Atlas Copco continues to drive innovation in auton omous vehicles. Additional semi-automated or automated equipment is also planned for or already in use in Australian coal and mineral mines, frequently with the assistance of remote operations centers located in or close to capital cities.

Contrarily, the full scope of change necessary in management systems and organiza tional culture has not always been taken into account when introducing any new technology, automated or semi-automated equipment, or mining process.

FAILURE SIGNS ARE FREQUENTLY MOST APPARENT WHEN:

In equipment support due to shortages of parts and maintenance/repair expertise.

A lack of pertinent facts to enable sound decision-making, as well as an abun dance of data that can cause "paralysis by analysis."

By staff members' disengagement with newly introduced technology, which results in subpar safety outcomes, subpar system performance, or inability to meet even the most fundamental production improvement goals.

Other drilling types have not been success fully automated, despite some subterranean rigs making headway in that direction, while blast hole drilling and offshore oil drilling have. While some manufacturers' land-based exploration drilling rigs offer hands-free drill pipe/rod handling, hands-free core barrel handling is typically not an option.

Automation has not yet been able to handle the large range of wellbore sizes and kinds that land production drilling rigs deal with. Due to the high value of the wells and the resource, oilfield rigs, particularly offshore rigs, have had either semi-automation or complete automation for at least ten years.

Drilling is just one step in the value chain of onshore exploration that involves finding, comprehending, and classifying a resource. Customers frequently do not view the lack of technology in the drilling function as a problem since they would rather focus on higher-value tasks like core analysis or min eral grading technology.

The installation of the final casing and fin ishing the wellbore have a significant impact on drilling for production, or the installation of dewatering, gas risers, and other similar devices, meaning that drilling itself has a lesser role in the process.

Directional drilling requires a delicate mix of strength and dexterity, and it depends on a reliable geo-model for wellbore design and execution. In the last three years, the use of oilfield technology has allowed integration of geological sensing instruments with a deeper level of research into the drilling assembly, providing better insight into the

correctness of geological models and assist ing with improved drilling decision-making.

When it comes to wellbore length, diame ter, or information needed for the drilling process, drilling clients frequently look for innovations that push the envelope of what is achievable. Although automation is frequently brought up, it hasn't been given much weight in drilling-related final decisions. Instead, in order to produce more useful data from the drilling process, mine operators are concentrating on safety and technological advancement.

Lucas, AJ

Since the drilling industry started in 2000, Lucas has accumulated a vast amount of experience and has been actively involved in the most cutting-edge drilling advancements for underground mining, directional drilling, and production wells for water and gas. To assist the business and promote the adoption of designed technology, Lucas

www.skillings.net | 17

tool technology. By actively interpret ing "as-drilled" geology, comparing it to modeled geology, and making real-time wellbore changes, experienced employ ees can actively direct the well toward the intended geological horizon by using real-time sensing data. If necessary, geo-steering can be done remotely or on the rig site.

By designing boreholes without on-site welding, a major supplier and I created big-diameter threaded casing, which con siderably shortened installation time. In the past, a borehole had to be left open for extended periods while the liner casing was installed and welded, which increased the chance of a wellbore collapsing and, in the case of an underground mine, the amount of groundwater that needed to be handled. Threaded casing connectors with a large outside diameter shorten installation time from weeks to days.

created an internal drilling engineering and directional drilling service over the course of the past 22 years.

For data-driven decision-making and suc cessful client outcomes, Lucas Drilling concentrates on the combination of engi neering experience and adequately updated technology.

IMPROVEMENTS IN ENGINEERING-BASED TECHNOLOGY THAT HAVE BEEN EMBRACED INCLUDE:

Rack and pinion rigs, which were intro duced in 2004 and have now evolved into high-capacity, PLC-controlled rigs with a drilling depth of more than 3000 metres. The larger capacity rigs are utilized for gas drainage and enable the deploy ment of the geological sensing tools to greater depths as part of a structured data collecting strategy to support better

mineable horizon planning. These rigs are typically employed for extended-reach lateral directional drilling.

Planning drilling programs and leaving the field team to carry out operations has evolved into a closed loop plan, drill, check, and adjust process with a head office drilling engineering staff to support real-time decision-making on the rig.

Off-site directional control, where appli cable, has increased efficiency by enabling a single directional drilling specialist to assist numerous rigs. Real-time data col lection and data from downhole drilling tools broadcast through a secure network created in collaboration with the down hole equipment supplier assist off-site operations.

Geo-steering has been made easier by the integration of rig data acquisition and advancements in downhole geo-sensing

Casing packers with a large diameter that enables high-quality casing cement ing, especially on breakthrough holes, considerably decreasing underground contact and speeding up completion times. Traditionally, the initial cement seal is laid from beneath, and a staged cement seal is installed from the surface to complete the wellbore where wellbore liners penetrate into underground workings. A single pass cement operation can be pumped and finished faster when a bigger diameter casing packer is used.

If the value added to the drilling process justifies it, new technology will continue to be a blend of engineering solutions, progressing toward semi-automation and eventually complete automation.

The "trickle down" effect of other automa tion techniques and technology, especially where mining operators are experiencing demonstrated benefit, will offer the customer pull to balance the supplier push and should produce an output that is fit for purpose.

Before implementing a technology upgrade, it would seem reasonable to view the "whole mining process" as an engineered system in which all components should be prioritized. However, this has not always been the case.

18 | SKILLINGS MINING REVIEW October 2022 SURFACE MINING

Slam Exploration Mobilizing to Drill Gold Veins at Menneval

SLAM Exploration Ltd. (“SLAM” or the “Company” on TSXV: SXL) is pleased to announce it is mobilizing a diamond drilling rig a drilling program on its whollyowned Menneval gold project located in the mineral-rich province of New Brunswick, Canada. The rig is to be transported over the weekend, with drilling expect to start on or about Monday, September 19, 2022.

The slam exploration intends to drill up to

1,000 metres in approximately 10 holes to test 2 gold zones discovered by SLAM in 2020-2021. This includes up to 6 holes on Zone 18.

These holes are planned to test for extensions beneath core intervals grading up to 162.5 g/t gold over 0.2 m and 56.50 g/t gold over 0.51 m associated with visible gold in holes reported by the Company on December 03, 2020, and January 20, 2021. Previously, the

Company had announced multiple sites of visible gold with assays up to 3,955 g/t gold over 0.10 m thick from trench samples reported on December 03, 2020.

scan the qr code to read the full story on our website

Proud to be your reliable partner.

We have long supported the region’s mining industry by providing safe, reliable and competitively priced electricity. In 2021, half of the energy we provide to all of our customers will come from renewable sources.

Together, we power northeastern Minnesota’s economy.

www.skillings.net | 19

mnpower.com/EnergyForward 19260

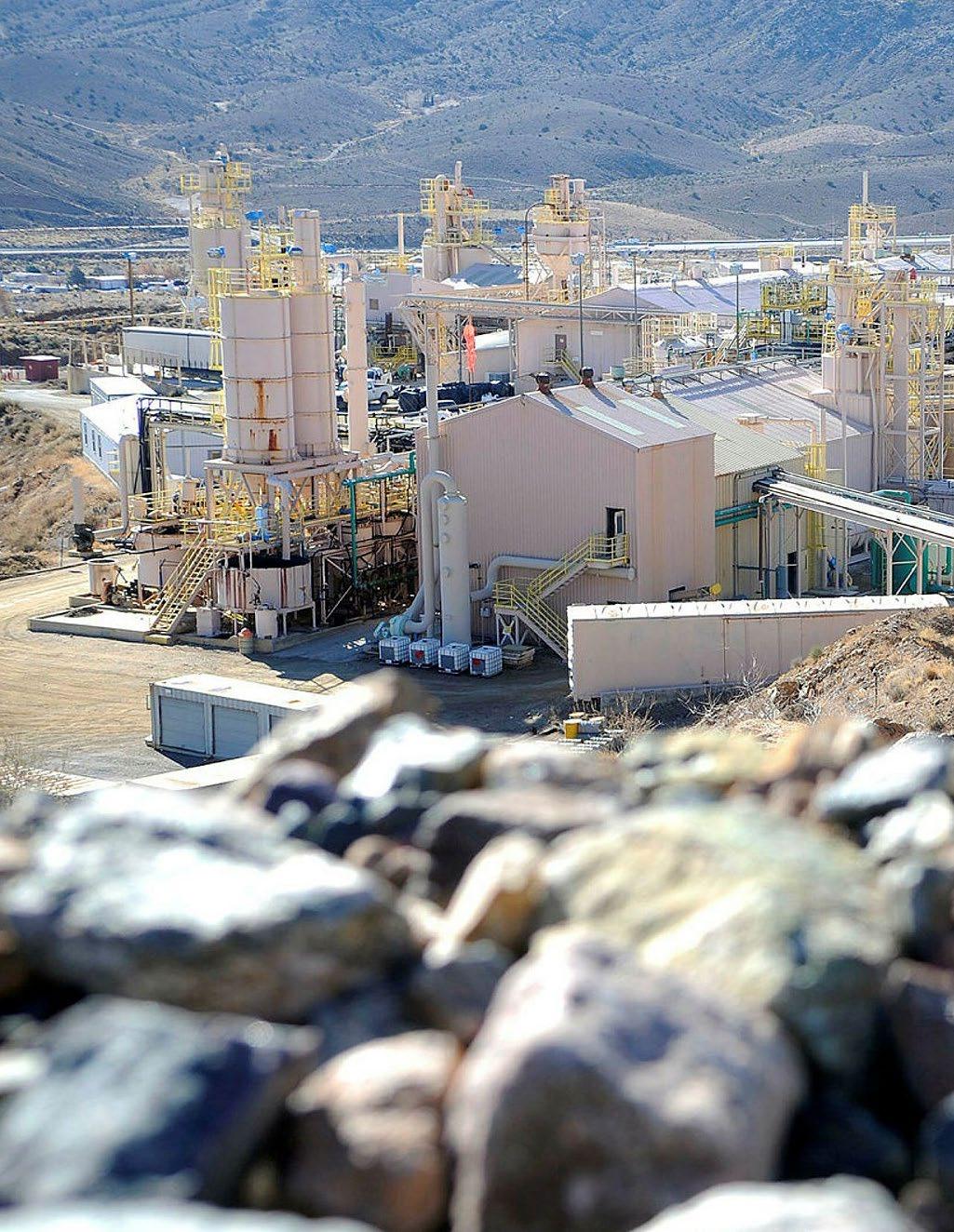

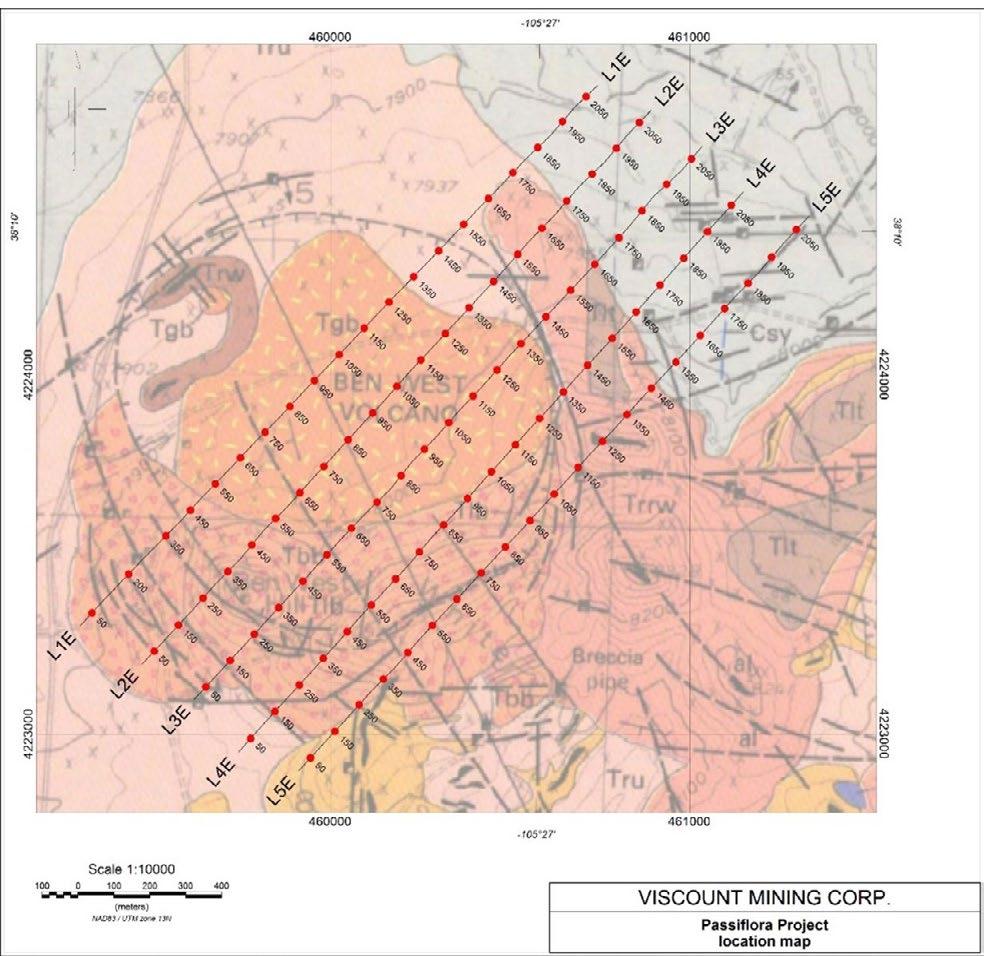

Viscount Mining TITAN MT Survey Confirms Conductive Anomaly at Silver Cliff, Colorado

As vErifiEd by QuAntEc gEosciEntists, thE rEsults of thE titAn Mt survEy conductEd by vis count Mining Corp. on Passiflora in Silver Cliff, Colorado revealed a huge system of interconnected min eralized fractures likely indicating porphyry.

During the early summer of 2022, Quantec Geoscience had been contracted by Viscount mining to perform a five-line TITAN MT survey over the Silver Cliff caldera of the Passiflora target. The goal of the survey was the identification of conductive areas below the survey surface which could potentially represent metal deposits or the presence of porphyry.

Quantec is authorized by the Association of Professional Geoscientists of Ontario (PGO). Its roster of clients includes New mont Mining, Barrick Gold, Agnico-Eagle Mining, De Beers Consolidated Mines Lim ited, and the Nevada Department of Energy amongst others.

For the current project, each of the 5 parallel lines surveyed by Quantec were 2.2 kilome ters (1.36 miles) in length and separated by 175 meters (574 feet). Ground-penetrating resistivity data was gathered overnight from each survey line. This data was analyzed and converted into cross sections.

TITAN MT survey identified extremely low resistivity zone

In their executive summary, Quantec declared that: “The TITAN MT survey identified a zone of extremely low resistivity in the Silver Cliff caldera.

The main anomaly is bowl-shaped and at a depth of ~450m (~1475 ft) at the point nearest to the surface below lines L1E and L2E… The 2D and 3D modeled depth of the anomaly extends ~1500m (~4920 ft) deep, or to an

An aerial image showing locations of the five TITAN MT survey lines positioned over the Silver Cliff caldera.

elevation of ~900m (~2950 ft), but the source could be deeper. The extreme conductivity of the anomaly and sensitivity of the MT method limit resolution of the inversion result below the massive conductive zone.”

Viscount CEO Jim MacKenzie commented, “In response to these extraordinary findings,

Viscount is currently putting together a drill program aimed at determining the compo sition of the very high conductivity source.

Quantec Geoscience stated this is one of the lowest resistivity anomalies they have ever seen. The Quantec survey shows that the geophysical foot print has the indication

SURFACE MINING

20 | SKILLINGS MINING REVIEW October 2022

that we are looking at a potentially signifi cantly large mineral system at the Passiflora.” Talking about the structure of the anomaly, Quantec added: “there are branches oriented in a roughly E-W direction that come closer to the surface to ~320m (~1050 ft) depth below lines L4E and L5E in the south-eastern part of the grid. These branches could be related to fault-controlled mineralization or alteration.”

The only historic report about the Passiflora target was written by R. A. Rivera for Coca Mines in 1983. In this report, Rivera outlined a brief history of exploration efforts in the area and had inferred a potential deposit size of 40 million tons of AgEq in the form

of silver, gold, lead, and zinc (not NI 43-101 compliant). This report stated that the deposit was presented as “a set of steeply dipping, NNW striking, tabular mineralized zones” (Rivera, 1983).

It was also implied that the deposit could possibly go much deeper as Rivera had high lighted that some drill holes presented high assay values at their total depths.

Viscount mining has drilled six drill holes throughout the Passiflora target.

The deepest of these goes 215m (705 ft) below the surface. Evident phyllic alteration and associated metal concentration increases

were observed throughout the entire drilled depth in each of the six holes.

Viscount Mining was inclined to further explore the probability of the Passiflora target presenting as porphyry at depth because of the level of increased alteration displayed along with the volcanic history of the region as a caldera. Jacob Hooker, Silver Cliff Exploration Manager emphasized that: “This caldera is one of at least ten eruptive centers of the Central Colorado Volcanic Field (CCVF). Four of these ten have been further classified as silicic eruptive centers, of which the Silver Cliff caldera is one (McIntosh and Chapin, 2004).

SOLVING YOUR MOST COMPLEX CHALLENGES. With SEH, you are a true partner and collaborator. Engineers | Architects | Planners | Scientists 800.325.2055 | sehinc.com/subscribe

www.skillings.net | 21

Novel Self-Propelled Bale Chaser: Contractor Work

coming up with creative solutions to hauling hefty straw bales more effectively for years.

High-capacity grabs, trailers with hydraulic sides for securing loads, and several sophisticated chasers for gathering and stacking without the need for a loader are the results of their efforts.

Nevertheless, Joe Williams of Eastern Counties Straw believed that there was still opportunity for growth. He had been using 16-bale Heath Super Chasers for some time, but he was looking for a quicker and more dependable way to corral the 120x90cm bales that his eight-string Krone balers were producing.

His initial effort was to design a massive trailed chaser with a tri-axle chassis that could hold 32 bales in a single load, dou bling capacity.

Even with a 300hp Fendt up front, it oper ated reasonably well but was too heavy to pull in anything but bone-dry conditions. Instead, he shifted his attention to improving the efficiency and dependability of the task of collecting 16 bales. Instead of creating a

device to pull behind a tractor, he chose to create a self-propelled bale collector based on an eight-wheel lorry to do this.

Although he had seen single-row stacks con structed in the US and Australia, he believed he could accommodate a double row on the back deck. After a few sketches and a few miniature mock-ups, Mr. Williams entrusted the construction to engineering genius Tim Ansell, who owns the sibling company of Eastern Counties Straw, JW Fabrications.

However, Mr. Ansell has been producing and repairing agricultural machinery for the company for the past 15 years (see "JW Fabrications" below). Mr. Ansell got his start building and maintaining the gold mining equipment.

The project was prepared for testing during the 2021 season, but it has been success fully moving more than 4,000 bales this year. The engineering division of Eastern Countries Straw, JW Fabrications, special izes in creating, modifying, and maintaining

agricultural equipment. While it performs some jobs for farmers and other contractors, most of its work is for the straw industry. Previous initiatives include a silage elevator that enables corn to be loaded into trucks parked on the side of the road to prevent mud from getting on the road.

The first was created for the company's internal usage, but they decided to create a few more due to its popularity. It has since created a new version based on a sizable snow blower.

This has the advantage of an adjustable spout, allowing for the even loading of trailers with out the need to shunt them back and forth.

Tim Ansell and his team of engineers also developed a special service trailer for the

fArMErs, contrActors, And EQuipMEnt MAnufActurErs hAvE bEEn

Photos: fwi.co.uk/ © James Andrews

22 | SKILLINGS MINING REVIEW October 2022 MINING EQUIPMENT

www.skillings.net | 23

MINING EQUIPMENT

company to accompany them while on the maize campaign. Based on a tri-axle chas sis, it has room for a 10,000-liter diesel tank, AdBlue storage, generator, telescopic floodlight, two pressure washers, a full com plement of tools, and of course, a gas grill.

What it does

A hydraulic arm at the front of the truck picks up bales and puts them onto a platform with hinges on the cab roof. Then, at the front, it is raised, creating a slope down which the bales slide before falling on their side on the back deck. A second bale is dropped on top of the first, creating a double layer, and is then pushed down the bed by a hydraulic headboard to make room for the following pair.

Hydraulic fingers lift out of the truck to anchor the first row of bales as they settle into position, preventing them from tip ping over. These then descend once more, enabling the bales to be pushed back. This accommodates eight rows, resulting in a total capacity of 16 bales.

The entire bed is tilted upward during unloading so that the bales can be placed upright. To step the top half of the weight and create a more stable stack, a few flaps pop out of the floor simultaneously. Additionally, a hydraulic arm is located at the base of the bed to assist in pushing the load into the stack as the driver backs up. It is easy to use because a single electronic joystick positioned on the driver's door controls all functions.

Faster Loading

The truck's capacity may be the same as that of the company's trailed chasers, but it can collect a lot more bales every day. There are several causes for this. First, the lorry is small and has good suspension, so it can easily squeeze through narrow openings and travel along rugged terrain without risking toppling bales or shaking the driver's teeth out.

If you want, you can sprint down the field at 50 mph, Mr. Williams says. The fact that it consistently produces stable stacks that hardly ever topple is the largest perk, though. The front loading arm, which centers each bale as it is taken up, is the key to this.

In contrast to many other chasers, which require some operator ability to poke the loading spike into the bale at the proper spot, there is no margin for error with this one.

Additionally, it uses less fuel than a tractor and trailed chaser, consuming only 200 liters for an entire shift.

Developing It

The 2013 Scania eight-wheeler dust cart with an up-and-over loader on the front served as the foundation for the lorry chaser.

The bale chaser project didn't employ any of the original mechanisms. Still, this model was appealing since it included a sizable spool block with air solenoids that could be used to power the intricate hydraulic services.

After stripping the truck down to its bare chassis, Mr. Ansell and his team started building the chaser. The loading arm was the first to be constructed, and because of its intricate geometry, a scale model was constructed before actual construction could start.

The arm's clever ability to move in a wide arc allows it to pick up a bale from the ground and then hoist it vertically so that it is at roof level. With a pair of connected hydraulic rams that ensure the bale is always fastened in the middle, the hydraulic gripper arm is also cleverly designed.

Additionally, the grab is weighted such that the bale falls back onto the roof platform when the arm is leveled up to its maxi mum height.

The main obstacle was getting the roof

platform to raise high enough for the bale to slide off and onto the rear bed because there was so little room for the rams to fit between it and the cab roof. The platform fires up quickly to knock the bale off its perch once they have managed to get the angles just perfect. The manufacturing of the rear load area was simpler than that of the front end. However, some of the little elements received considerable care.

These include the stack stepping plates in the base, some spring lugs on the side of the frame to prevent them from tipping forward, and the securing fingers that prevent the first row of bales from falling backward. All new steel was used in the construction, and an Esprit Automation profile cutter was used to cut several pieces.

Mr. Ansell does the CAD drawings for this project by himself. Therefore, not a lot of the labor was outsourced. With almost a dozen hydraulic rams on board, the team recruited some assistance to quickly install the device. Phil Nelson, a retired electronics engineer, and expert in hydraulics was given this task. He was successful in getting a tiny, computer-style joystick to communicate with the lorry's air solenoid spool block.

Installing an automatic fire suppression system with tubes that burst in the case of a fire and spray suppressant all around the machine served as the finishing touch.

In order to prevent flammable material from accumulating, they also had a custom-built tarpaulin manufactured, which is positioned at the back of the cab.

Modifications

The hydraulic system is now semi-automated and has a number of flow restrictors to allow some rams to move before others.

The next stage, according to Mr. Nelson, is to totally automate it, so that when the bale has been picked up, no operator input is

24 | SKILLINGS MINING REVIEW October 2022

needed. A reverse fan will also be installed on the truck as part of plans to keep it cool in dusty circumstances. The chaser may be simply unbolted and removed because it was designed as a demountable device.

Mr. Williams wants to equip the vehicle with a Bergmann muckspreader and perhaps a silage body so that it can haul grass in order to make better use of it.

Use in Agriculture

The truck can be operated by any operator and run on red diesel if it is registered as an agricultural vehicle.

To help spread the weight and improve the vehicle's performance on uneven terrain, the rear wheels have also been changed with large rims that are fitted with BKT 560/45 R22.5 tyres. It is intended to replace the stock 295/80 R22.5 tires on both front axles with 500mm tires, the greatest size that will fit without running the danger of rubbing during turns.

Although the vehicle does not have all-wheel drive, both of the rear axles are engaged, and a diff-lock is available if necessary. For the past two years, traction has not been an issue, and Mr. Williams believes it is capable

of handling ground conditions at harvest, even in years when the going is difficult.

Building custom

Since the design has been refined, JW Fabrications is willing to construct or hire out similar instances for other companies.

Prices will probably start at roughly £120,000 plus the cost of a donor truck. The 2013 Scania utilized on the first machine cost approximately £20,000 and had 100,000 miles on it. The chaser can be modified to work with bales of various sizes, but it is intended for 120x90cm bales.

www.skillings.net | 25 Industrial General Contractor Specializing in Equipment Installation and Maintenance crmeyer.com 800.236.6650 Offices: Byron, GA Escanaba, MI Muskegon, MI Coleraine, MN Tulsa, OK Chester, PA Oshkosh, WI Green Bay, WI Rhinelander, WI Millwrighting Piping Ironwork Concrete Electrical Building Construction Design/Build Offices Nationwide l l l l l l l Boilermaking l

Great Lakes Iron Ore Trade Down in August

Shipments of iron ore on the Great Lakes totaled 5.1 million tons in August, a decrease of 9.1 percent compared to a year ago. Ship ments were also below the month’s 5-year

average by 8.7 percent. Year-to-date, the iron ore trade stands at 24.2 million tons, a decrease of 24.5 percent compared to the same point in 2021.

Through August, iron shipments are 22.5 percent below their 5-year average for eight months of the year.

Great Lakes Iron Ore Shipments: August 2017-2022 and 5-Year Average

Includes Transshipments to Quebec City for Shipment Overseas (net tons)

Port 2017 2018 2019 2020 2021 2022 Average 2017-2021

Duluth, MN 653,815 753,097 1,034,173 784,565 1,132,118 783,957 871,554 Superior, WI 1,549,998 1,676,254 1,543,211 657,807 1,248,826 1,606,770 1,335,219 Two Harbors, MN 1,971,440 1,961,521 1,787,273 994,491 1,273,085 1,504,048 1,597,562 Silver Bay, MN 915,739 785,494 580,885 360,469 801,687 150,111 688,855 Marquette, MI* 790,977 765,107 806,181 510,505 728,542 748,384 720,262 Escanaba, MI** 0 0 0 0 0 0 0

Cleveland, OH*** 180,830 268,238 110,374 147,974 437,166 315,297 228,916 Ashtabula, OH 236,988 206,022 172,670 149,741 0 0 153,084

Total 6,299,787 6,415,733 6,034,767 3,605,552 5,621,424 5,108,567 5,595,453

*Marquette = Presque Isle in previous reports. **Dock ceased operations in April 2017. ***Transshipments within Cleveland Harbor Information is based on data from knowledgeable sources.

Year-To-Date 2017-2022

Port 2017 2018 2019 2020 2021 2022 Average 2017-2021

Duluth, MN 4,350,625 4,509,771 5,576,124 5,142,219 5,454,653 3,953,770 5,006,678

Superior, WI 7,477,377 7,886,178 7,036,717 4,210,602 7,394,740 6,974,867 6,801,123

Two Harbors, MN 10,215,368 10,098,301 10,541,206 7,709,362 9,476,573 8,092,503 9,608,162

Silver Bay, MN 4,056,312 3,960,752 3,177,212 2,311,974 3,373,700 1,013,474 3,375,990

Marquette, MI* 4,200,978 4,020,679 4,062,560 2,838,319 4,205,874 3,045,504 3,865,682

Escanaba, MI** 1,016,867 0 0 0 0 0 203,373 Cleveland, OH*** 1,899,257 1,764,640 1,483,492 1,542,625 2,099,557 1,107,183 1,757,914

Ashtabula, OH 618,940 790,350 912,701 548,380 28,553 0 579,785

Total 33,835,724 33,030,671 32,790,012 24,303,481 32,033,650 24,187,301 31,198,708

26 | SKILLINGS MINING REVIEW October 2022 STATISTICS

www.skillings.net | 27FloLevel Technologies

SPECIAL FOCUS

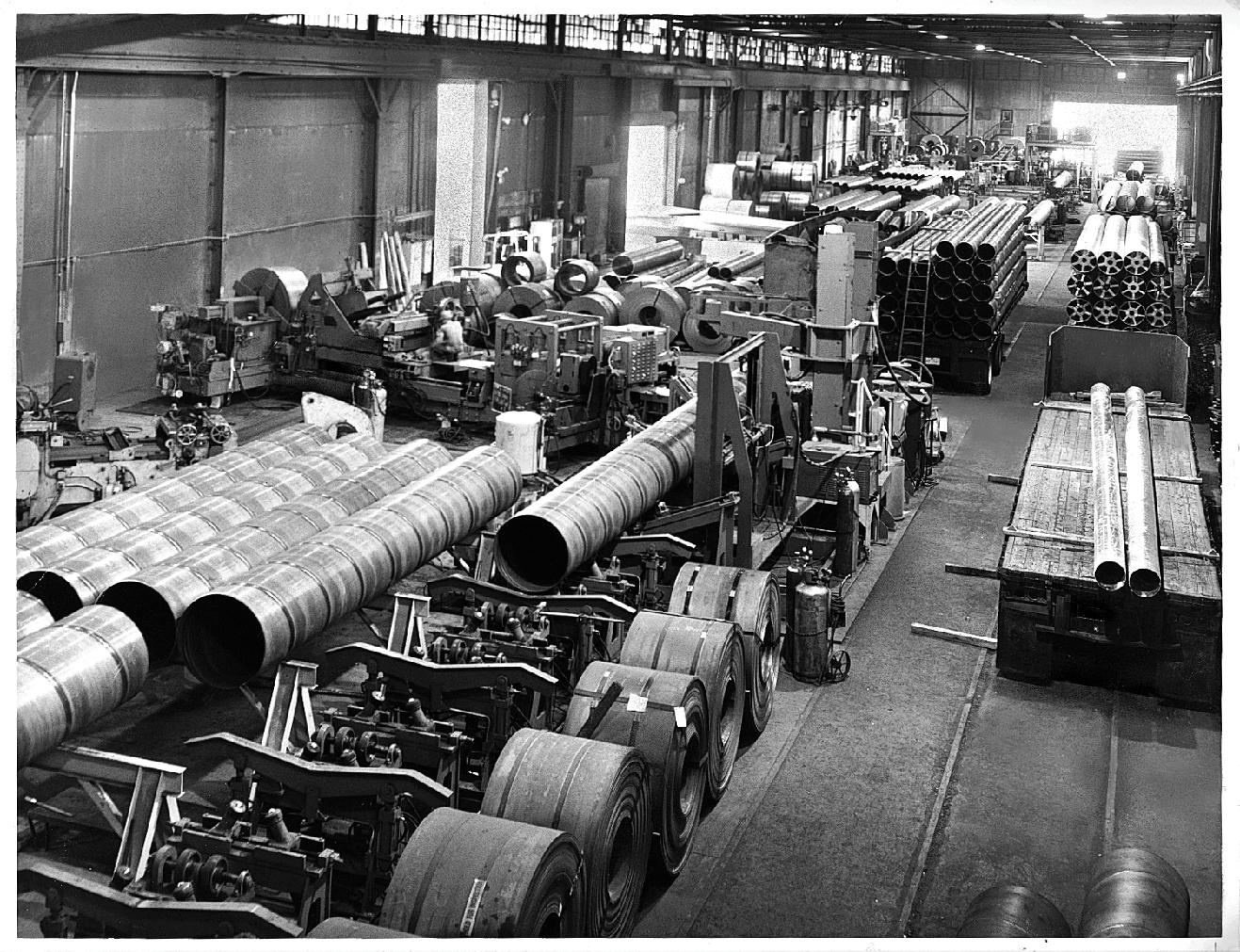

The Grängesberg mine, the central shaft headframe and enrichment plant, in the 50s.

The Grängesberg mine, the central shaft headframe and enrichment plant, in the 50s.

28 | SKILLINGS MINING REVIEW October 2022

Dalarna County, Sweden.

Grängesberg Iron Ore Resuming

After more than 150Mt of iron ore was produced, the Grängesberg mine in Dalarna County, Sweden, was shut down in December 1989 due to market conditions. One of northern Europe's largest homogeneous iron ore deposits are the mining deposit at Grängesberg.

I

n May 2014, the UK-based mining company Anglesey Mining signed a contract to buy a controlling stake in the project, including a direct 6% stake in the mine's Swedish owner, Grängesberg Iron AB (GIAB). Anglesey intends to reopen the project's mining operations.

In April 2012, a pre-feasibility study (PFS) for the Grängesberg mine was finished. The Swedish Mining Inspectorate granted the project a 25-year mining permit in May 2013. The business made a small investment in late 2019 and more investments throughout the years, which allowed it to obtain a 20% direct interest, managerial rights, and a right of first refusal to extend its position to 70% in the project.

A revised PFS with a 16-year life of mine (LOM) and a $559.6 million projected invest ment was released in July 2022.

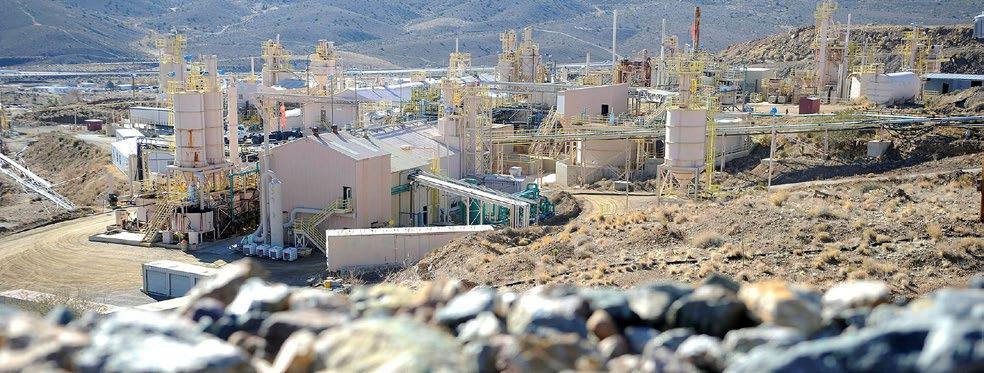

The site of the Grängesberg mine

The project is situated in the central Swedish mining district of Bergslagen, 10 kilometers

southwest of Ludvika. The site's location is around 200 kilometers (km) northwest of Stockholm, the country's capital.

Underground iron ore mine: reserves and mineralization

The mineralization in Grängesberg is composed of apatite-iron oxide ore, which also contains a small amount of haematite (Fe2O3) and magnetite (Fe3O4).

Due to the oxidation of arid pegmatite sills and dykes, the northern portion of the deposit has greater haematite mineralization. With deeper drilling, the haematite content declines and gives way to pure magnetite. As of July 2022, it is predicted that the probable mineral reserves of the Grängesberg iron ore project will be 82.4Mt grading 37.2% iron (Fe) with a total iron content of 30.7Mt.

Mining techniques

The 2012 PFS assumed that historical sublevel caving would continue, while the amended PFS for 2022 suggested sublevel

open stopping with the backfilling of mined stopes for future designs.

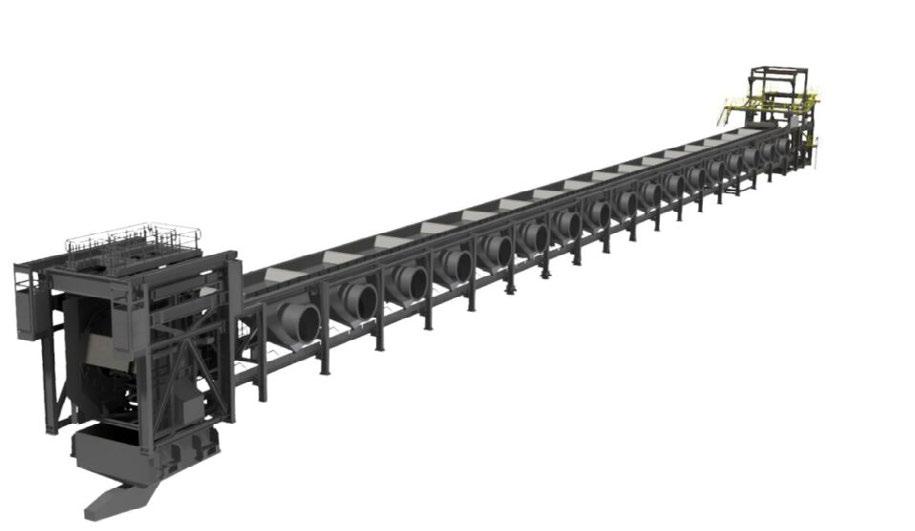

Run-of-mine (ROM) ore will be transported to the underground crusher station, which includes a single toggle jaw crusher, a grizzly feeder to filter oversize material at 900mm, and an 80m3 feed hopper with a bypass channel.

The crushed ore will be moved from a vibrat ing feeder to a conveyor attached to the skip hoist, where it will then be transferred to surface stockpiles.

Processing

The project will contain a concentrator with an annual availability of 333 days (91%) and a processing size of 5.3Mtpa of ore at a notional processing rate of 666tph. The concentrator building is 40 meters wide and 150 meters long. It has a plant control room, utilities, reagent preparation, electrical switchgear, and numerous pieces of equipment for grinding, separation, flotation, and filtering.

www.skillings.net | 29

SPECIAL FOCUS

A primary crusher, primary autogenous grinding (AG), classification, and secondary semi-autogenous grinding will be included in the processing units (SAG). Solid/liquid separation, froth flotation, and magnetic separation will all be applied to the crushed ore. The tailings management facility will immediately store the unthickened tailings.

The piled-up ore will be discharged by vibrating feeders onto a conveyor belt that will feed the AG primary grinding mill. Peb bles from the AG mill will be collected by a trommel screen and used as grinding media in the secondary SAG mill.

The undersize will be sent to the primary wet low-intensity magnetic separators, and the screen oversize shall be recycled back to the AG mill (LIMS).

Before secondary grinding, the magnetite iron ore will be upgraded in the main LIMS stage. The haematite-containing non-magnetic slurry will be thickened and dewatered. To boost the haematite, the thickener underflow will be moved to a primary high-gradient magnetic separation consisting of SLon Vertical Ring and Pulsating High-Gradient Magnetic Separators (SLon VPHGMS).

Fine magnetite and haematite with a p80 size of 40µm will be produced by the sec ondary SAG mill when it runs in a closed circuit with a hydrocyclone cluster. The second stage of LIMS separators will be used on the hydrocyclone overflow, and the non-magnetic slurry containing the haema tite will be thickened and dewatered. The thickener underflow will be treated using SLon VPHGMS in a secondary high-gradient magnetic separation.

The magnetic separation concentrates' sulfur and phosphate content will be reduced in a reverse flotation circuit. The iron ore con centrate-containing flotation tailings will be thickened and dewatered. The dewatered filter cake from the thickened underflow

Key Project Metrics

THE KEY PROJECT METRICS ARE SHOWN IN THE TABLES BELOW.

Key Metric

Unit 2022 PFS Update

Ore to Mill Mt 82.3

Life of Mine Years 16.0

Contained Fe Mt 30.6

Recovery % 85

Recovered Fe Mt 26.0

Outgoing Concentrate Mt 37.2

Concentrate Grade % Fe 70

Average annual Concentrate Output Mt 2.3

Cash cost* US$/t Conc 53.60

All-in Sustaining Cost** US$/t Conc 57.80

Pre-production capital US$m 399

Post-tax NPV8% % 688

Post-tax Internal Rate of Return % 26

Project payback

Years 3.6

Average annual Post-tax Operating Cashflow *** US$m 130

* Cash costs are inclusive of mining costs, processing costs, site G&A, transportation charges to port and royalties

** All-in Sustaining Cost includes cash costs plus sustaining capital and closure cost

*** Post-tax Operating Cashflow based on iron ore price forecast of US$120/t China CFR 62% Fe benchmark

will then be transferred to a pellet factory for further processing to create iron ore pellets.

Infrastructure

The proposed site's surface infrastructure already consists of roadways, office buildings, workshops, and processing facilities.

The Grängesberg mine site is close to regional power lines and switchgear, and the project intends to use municipal power supplies generated by wind energy. It is suggested that most water supply comes from dewatered reclaimed mining water. The mainline railway is also on the property,

giving direct access to the 250 km south of the mine at Oxelösund port.

Contracting parties

Micon International, a mining consultant, was hired to create the project's 2022 PFS. The independent international engineering company URS Corporation undertook the PFS, which was finished in April 2012.

A geotechnical evaluation was carried out by the infrastructure consulting company AECOM as part of the 2012 PFS preparation process to examine the mine's stability, prof itability, and economic and financial value.

30 | SKILLINGS MINING REVIEW October 2022

Vale Unveils the Next Sustainable Sand Operation

with thE initiAtion of indus trial-scale production of the by product at its Viga mine in Cong onhas, Minas Gerais, Brazil, Vale has expanded its Sustainable Sand initiatives to a second location.

Sand can be processed at a rate of 200,000 t/y, of which 80,000 t are planned for 2022 and 185,000 t for 2023.

Sustainable Sand, a product of the treatment of iron ore tailings, is one of the company's endeavors to lower the usage of dams in its Minas Gerais operations. The product may replace riverbed-extracted natural sand and has numerous uses in the civil construction industry.

"Due to the geological characteristics of the mine and the mineral processing technology applied, we developed a coarser sand, with low presence of fine particles in the mate rial, and high purity content, having in its composition between 89% and 98% silica and less than 7% iron," said Jean Menezes, Operations Manager of the Viga mine plant.

Utilizing the on-site logistics, the company is already testing the substance with concrete and mortar manufacturers in the Southeast Region. Sustainable Sand is transported by rail from the production site to the clients.

The Viga mine is Vale's second facility to produce Sustainable Sand on an industrial

scale while maintaining the same high stan dards for quality as iron ore. The first one processed 250,000 t of the material last year at the Brucutu mine near So Gonçalo do Rio Abaixo, Minas Gerais. According to corporate estimates, production of Sustainable Sand will start at 1 Mt this year and double in 2023.

According to Vale, for every ton of sand pro duced, one ton fewer tailings are piled up or dammed up. The tailings filtration system is just another move Vale has taken to lessen its

reliance on dams and promote the mining of Sustainable Sand. By lowering the moisture content of the tailings, the method enables dry stacking of the material as well as the production of sand for the market.

Minas Gerais has installed four tailings fil tration plants: one in the Vargem Grande Complex (2021), two in the Itabira Complex (2021 and 2022), and one in the Brucutu Mine (in 2022).

www.skillings.net | 31

TRINA

FOR

AND

IGELSRUD PFEIFFER INTERIM DIRECTOR, CENTER

CARBON CAPTURE

CONVERSION, UNIVERSITY OF WYOMING 32 | SKILLINGS MINING REVIEW October 2022

Interview with Trina Igelsrud Pfeiffer

Interim Director, Center for Carbon Capture and Conversion, School of Energy Resources, at the University of Wyoming

For the October 2022 issue of Skillings Mining Review, we had the pleasure of interviewing Trina Igelsrud Pfeiffer, the Interim Director of the Center for Carbon Capture and Conversion (CCCC) in the School of Energy Resources (SER).

Originally from Denver, Pfeiffer earned both her B.S. and M.Sc. in Chemical and Petroleum Refining Engineering from the Colorado School of Mines in 1980 and 1990, respectively. Following the completion of her education, Pfeiffer immediately began working for an engineering corporation for over a decade before starting her own consulting company and served as the very first female local section chair for the American Institute of Chemical Engineers (AIChE) in the Denver area.

Pfeiffer has been instrumental in making the CCCC’s patent-pending thermo-chemical process technology a reality. The integrated coal refining system utilizes different conversion processes to break down Powder River Basin (PRB) coal and convert it into non-energy and fuel products with a minimal carbon footprint.

profiles in mining

www.skillings.net | 33

PROFILES IN MINING

pfEiffEr brings forty yEArs of technical experience with her to SER and a wealth of knowledge to help move projects in the CCCC closer to commercialization by finding alternative, high volume uses for Wyoming coal. Moving forward, she will also be serving as a co-principal investigator on a recently introduced rare earth element extraction project in the center. Pfeiffer will also take charge of the CO2 capture pilot plant that is currently being commissioned in the center.

Please tell us in detail about your edu cational background.

“I have Bachelor of Science and Master of Science degrees in Chemical and Petroleum Refining Engineering from the Colorado School of Mines. When I was a student at Mines, there were not many women attending. It had six fraternities and no sororities — not that I was interested in that, but you get the idea! It has changed dramatically since I went there, which is a good thing. I believe there are currently about 25% women attending Mines.”

Please talk about your professional expe riences; how did you reach your current designation?

“I have been in several different roles throughout my career. From a process engineer working on designing equipment, relief systems and modeling chemical processes, engineering led to being in charge of designing and running pilot scale plants for the University of Wyoming.

I am now the director of the Center for Carbon Capture and Conversion, which oversees the lab scale, pilot scale and field demonstration scale for our coal refinery. The

34 | SKILLINGS MINING REVIEW October 2022

idea behind the coal refinery is to repurpose coal in non-thermal ways so coal products can be competitive and environmentally friendly. It is a way to keep coal alive in this ever-changing energy world.”

Provide details regarding your pres tigious institution P&P Innovative Software; what are the key turnarounds, discoveries and innovations that it has made, and what have been your con tributions?

“P&P has been one of the only companies to take the ASPEN (Advanced System for Process ENgineering) simulation program, which is the product of a Department of Engineering project that ended in 1980, and write affordable software for use in thermodynamic calculations, pressure relief design calculations and fluid flow calculations.”

What is your advice to young students considering metals/mining or envi ronmental sustainability as full-time professions?

“Students looking to get into chemical engineering have a great future ahead of them. There are more options now than when I graduated from school. In addition to oil and gas, chemicals and environmental arenas, there are also food, pharma, and renewable energy possibilities. It is a great field, and students can take so many paths.”

Throw some light on the new coal byproduct demonstration project.

“The demonstration plant is being built to showcase the heart of our coal refinery. There are two processes: solvent extraction of coal and coal pyrolysis that are the main focus.

The products from these two processes, coal extract and coal char, are intermediate products that can be used to make many downstream products: building materials, soil amendments, asphalt products and polymers, coatings and resins.

I think women wanting to enter this sector now have it much easier than in the past. It is still a male-dominated industry, but I think the old way of thinking is becoming less prevalent. It is very refreshing to see women in positions of power.

Most of these downstream products are field tested, and data is gathered on the pilot scale.

When the field demonstration plant is built, we will use the material generated from this plant to verify our lab data. Once our data and the processes have been verified, we will be ready for the commercialization of our coal refinery.”

You have been associated with so many companies in the energy spectrum. What are the common obstacles and shared benefits?

Obstacles: Overcoming economic difficulties caused by recurring economic cycles — boom or bust. Benefits: computer technology and communications advances have benefited all the companies.

What has been the impact of COVID-19 on the energy sector? The pandemic has been difficult for almost every sector.

“Low demand for oil due to people not driving or flying has been a real issue since the onset of COVID-19. The continued remote work environment and its effect on the everchanging corporate culture contribute to the lower oil demand. The weakened supply chain bottleneck can also impact corporate progress and development.”

How easy or difficult is it for women to get into this work now-a-days? Any particular advice for them?

“I think women wanting to enter this sector now have it much easier than in the past. It is still a male-dominated industry, but I think the old way of thinking is becoming less prevalent. It is very refreshing to see women in positions of power.”

What are your plans for the future?

“To see the coal refinery become a reality in the state of Wyoming.”

profiles in mining

www.skillings.net | 35

PiM

Audit: Intelligent Unmanned Mining

thE Mining industry is undErgoing A tEchnologicAl rEvolution as a result of numerous ground-breaking initiatives that have been introduced in recent years to address long-standing issues with sus tainability, safety, economic viability, and operational efficiency.

societal and technological advancement. The recovery of resources like coal, iron, copper, aggregates, and precious metals has changed the world and produced countless essential products, starting with early surface mining and continuing to the sophisticated deep underground operations used today throughout the globe.

From simple tools to the huge machinery used in open cast mines and deep under ground operations nowadays, technology has played a critical role in the growth of the industry.

T

his article will examine advancements in intelligent autonomous mining and how they might affect the direction of the sector in the future.

Mining with Intelligent Unmanned Systems: A Changing Sector

In the past, mining has been one of the main economic activities that has fueled

Technology is continually evolving with the sector, creating new prospects for enhancing mines' efficiency, safety, sustainability, and economic production.

36 | SKILLINGS MINING REVIEW October 2022 SPECIAL FOCUS

equipment that is advanced, autonomous, and linked has begun to take the position of human operators in mines, lowering labor costs and raising safety.

Another crucial expansion is the Internet of Things, which uses networks of sensors and actuators to collect data from linked devices and to improve monitoring and maintenance capabilities. Mining activities and industrial machinery have a smaller negative impact on the environment thanks to renewable energy.

Machine learning and AI are enhancing exploration, data collection, and preventive maintenance. A greater role for mobile 5G internet is being played, connecting every area of a mine in ways that were before challenging to do. The intelligent, automated mine of the future is made possible by the technological developments in the mining industry currently under development.

The Future of the Mining Sector: Intelligent Unmanned Mining?

Numerous miners have lost their lives in mining mishaps over the course of the industry's long history, including explosions

and cave-ins. As minerals that are deeper and more challenging to get are exploited in today's underground mining, the danger to the miners increases.

Even though technological advancement has made mining infrastructure safer for workers, there will always be a desire to reduce or eliminate labor presence in mines.

Mine collapses and other catastrophes can negatively affect the economic viability of mining operations, in addition to posing a risk to worker safety. When concerns are identified, workers must be evacuated, and mining operations must completely cease until the threat can be thoroughly analyzed.

Through automation and remote operations in remote, central areas, mining enterprises can now use less labor and boost safety and production. Big data, robotics, smart sensors, drones, 5G, artificial intelligence, the Industrial Internet of Things, and robots are just a few citations of the contemporary technology employed in intelligent under ground mining.

It is conceivable to transition mining from the labor-intensive operations of the past

Modern Technological Advances in the Mining Sector

So as to keep up with the needs of a changing world, the mining industry is currently undergoing a paradigm change in technical innovation. The need for the industry to address environmental, economic, and social concerns has been acknowledged by various sector actors, including businesses, governmental organizations, and researchers. In recent years, a number of transformational technologies have been created.

Equipment and procedures are becoming more automated, which improves safety, lowers costs, and streamlines operations. Workers at distant operation centers can access strong tool sets and are kept out of potentially dangerous circumstances. Robotic

www.skillings.net | 37

to the intelligent autonomous mine of the future by utilizing all available technologies at once. The foundation of the discipline is laid by the concepts of automation, mechaniza tion, visualization, and systematization. To improve and streamline operations, operators produce and use large amounts of historical and real-time data.

Reviewing the State-of-the-Art in Intelligent Unmanned Mining

The significance of this mining field study and the challenges that scientists and engineers are currently experiencing have been acknowledged in a review that has been published in the journal named "Energies" (https://www.mdpi.com/19961073/15/2/513). The work was written in collaboration with prominent scientists and researchers from the North China Institute of Science and Technology, the China University of Mining and Technology, the China Coal Research Institute, and Hohai University.

Sixty-four research publications were exam ined for the new paper, which offers various insights into recent developments in this field of study. Key technologies, mining methods, and general design system theories have all been explored in the study.

The report has outlined three major obstacles that must be solved for intelligent autono mous mining to be commercially feasible in the future. Low accuracy, poor coordination, and unreliable equipment are a few of the technology-related issues. Research should focus on these technical challenges because present systems only have a modest amount of intelligence.

The development of the field will be sup ported by the development of intelligent automation technologies, monitoring tech nologies, and control technologies. The field is very promising and provides the mining industry with a number of benefits as it meets modern needs and places more emphasis

Through automation and remote operations in remote, central areas, mining enterprises can now use less labor and boost safety and production. Big data, robotics, smart sensors, drones, 5G, artificial intelligence, the Industrial Internet of Things, and robots are just a few citations of the contemporary technology employed in intelligent underground mining.

on sustainability, environmental cleanup, worker safety, and cost-effectiveness.

Future Developments in Intelligent Unmanned Mining

The topic of intelligent unmanned mining