Mining Automation The Path To Sustainability

2022 DECEMBER IN REVIEW 111/12 us steel iron ore could bring new boom 18 implementing esg during a recession 28 2022 annual index of skillings mining review 40 07 continuous improvements

in terms of technology and machinery are needed to ensure that the competitive demand of metals is met in a safe manner.

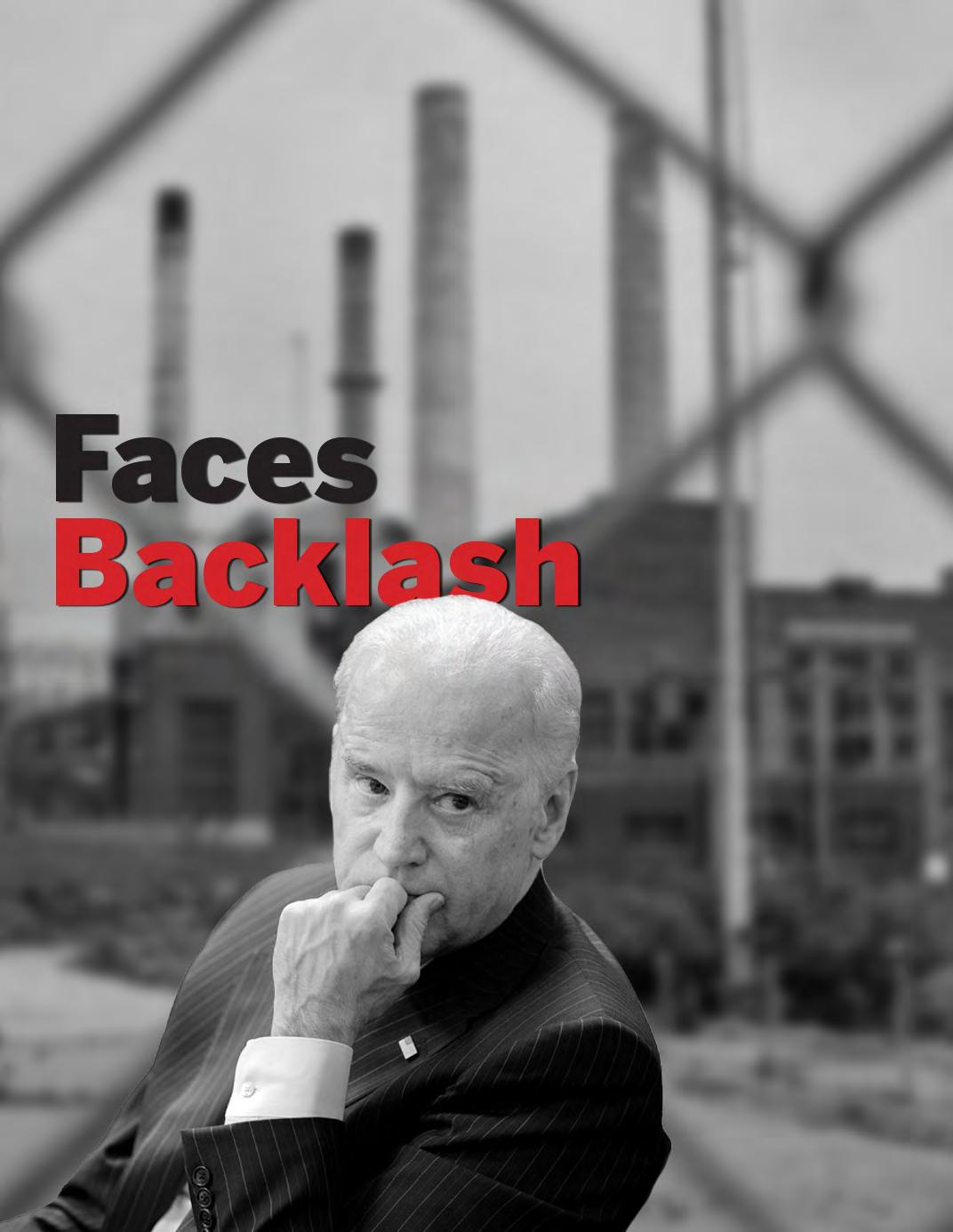

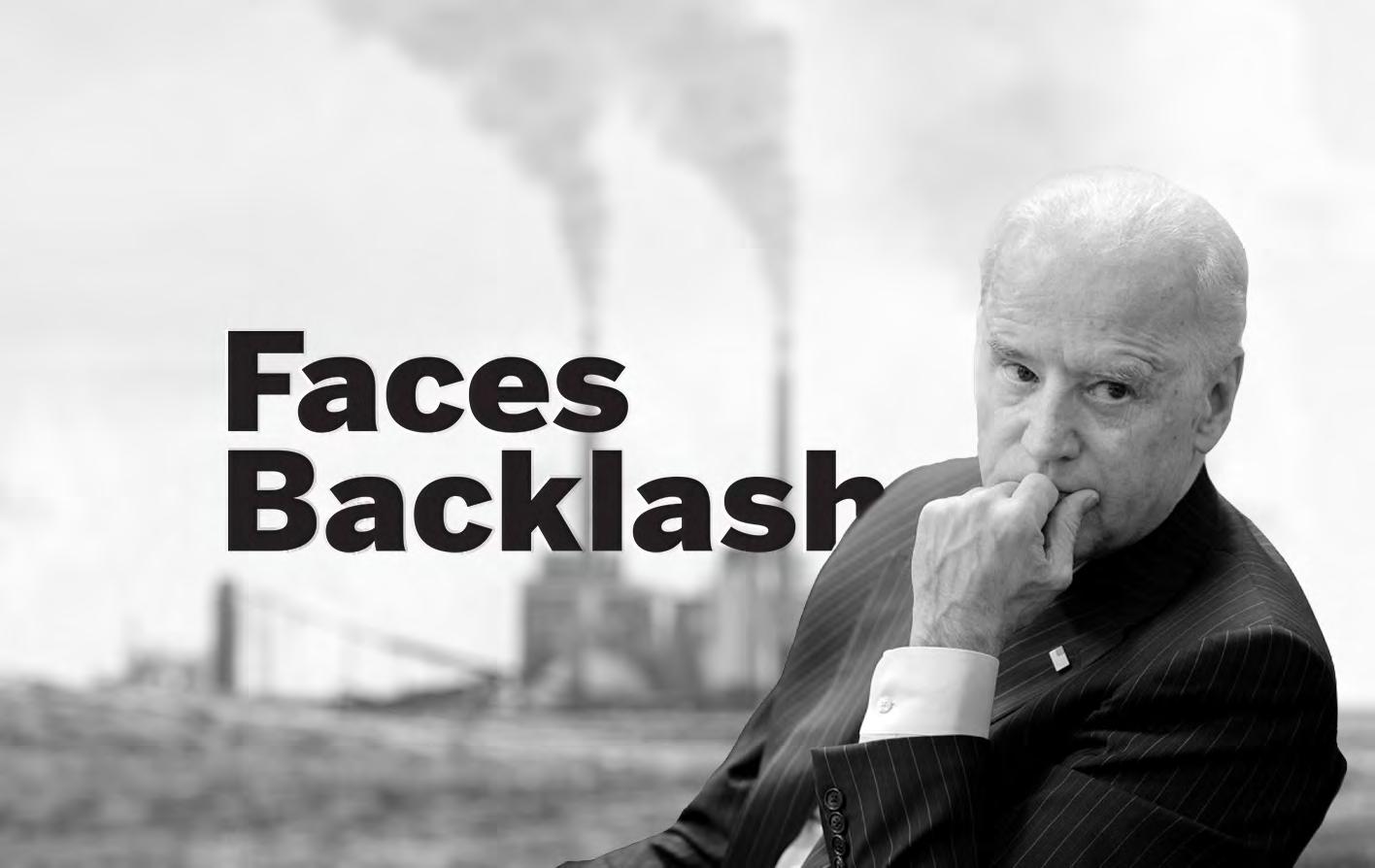

Biden Says Coal Plants ‘Across America’ Will Be Shut Down

2 | SKILLINGS MINING REVIEW December 2022 BIG RESULTS SMALL TEAM Optiro is a resource consulting and advisory group. Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software. In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results. +$15 BILLION DEALS/ VALUATIONS >780 MILLION oz Au RESOURCE AUDITS >64 MILLION oz Au RESOURCE ESTIMATES >3,000 CLIENTS +2,000 PEOPLE TRAINED 24 COMMODITIES 53 COUNTRIES >4,300 MILLION lb NICKEL >5,100 MILLION lb COPPER +5 IRON ORE BILLION TONNES www.optiro.com contact@optiro.com +61 8 9215 0000

www.skillings.net | 3

07 Mining Automation The Path To Sustainability MINING EQUIPMENT 34 World’s First Hydrogen-Pow ered Haul Truck Could Contribute To A Cleaner Mining Industry MINING FINANCE 10 Mining Projects in Latin America Face the Brunt of Inflation 18 US Steel Iron Ore Could Bring New Boom MINING JOBS 06 Hiring Levels In The Mining Sector Expected To Increase 22 Mines To Create 4,000 New Jobs in Zimbabwe 14 Deploying Artificial Intelligence To Help Fill The Short-Term Essential Minerals Gap 20 Career Prospects for Mining Engineers 21 Biden-Harris Administration Announces More Than $109M Support To Create Jobs 22 ArcelorMittal Creates Jobs in Liberia MINING TECHNOLOGY 38 Smart Technology Drives Promising Market Growth for Global Mining Automation SPECIAL FOCUS 36 Angola Set To Become Globally Competitive Mineral Producer 28 Implementing ESG During A Recession STATISTICS 46 October 2022 crude steel production 47 Crude steel production SURFACE MINING 06 Indian Government Accred its Thirteen Private Companies To Explore For Minerals UNDERGROUND MINING 05 Queensland Acland Coal Mine in Aus tralia Given $1Billion Adrenaline Shot 24 Biden Says Coal Plants ‘Across America’ Will Be Shut Down: Faces Backlash 27 US Mines More Coal In The West, But The East Employs More Workers 40 -2022 ANNUAL INDEX

THE LEAD

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS:

For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one. www.skillings.net

SKILLINGS MINING REVIEW (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284 Phone: (888) 444 7854 x 4. Printed in the USA. Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284.

Periodicals Postage Paid at: Venice, Florida and additional mail offices. Postmaster: Send address changes to: Skillings mining review, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Fax: (888) 261-6014. Email: Advertising@Skillings.net.

UNITED STATES $72 Monthly in US Funds $109 Monthly in US Funds 1st Class Mail OUTSIDE OF UNITED STATES $250 US Monthly for 7 - 21 day delivery $335 US Monthly for Air Mail Service SUBSCRIPTIONS SKILLINGS

NEWS ROOM

Monthly Magazine SMR Americas Monday Global Skillings Wednesday Skillings Equipment Gear Friday All funds are monthly $4.95 USD per month publisher CHARLES PITTS chas.pitts@skillings.net managing editor SAKSHI SINGLA sakshi.singla@skillings.net editor-in-chief JOHN EDWARD john.edward@skillings.net creative director MO SHINE mo.shine@skillings.net contributing editors ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE media production STANISLAV PAVLISHIN media.team@cfxnetwork.com media administrator SALINI KRISHNAN salini.krishnan@cfxnetwork.com director of sales & marketing CHRISTINE MARIE advertising@skillings.net profiles in mining mining.profiles@skillings.net general contact information info@cfxnetwork.com 2022 DECEMBER VOL.111. NO.12 Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

MINING REVIEW

Digital

4 | SKILLINGS MINING REVIEW December 2022

Queensland Acland Coal Mine in Australia

Given $1Billion Adrenaline Shot

BY ROBEL RAMOS

The region, where the unemployment rate is approximately 5.5%, will receive a $1 billion aid and will include 600 jobs on offer.

Initial earthworks have already started in the Acland Coal Mine, but New Hope hasn’t launched recruitment for the time being. Dave O’Dwyer, General Manager of New Hope, said that there was already significant

interest in jobs. O’Dwyer said that some pre vious employees and engineers had hinted at going back to the region to work in the mine.

"A lot of people had moved and worked in the Bowen Basin…doing long commutes…

away from their families," he said. "Some of our engineers went right up to Moranbah on a 10-day roster."

Around 80 to 100 workers are expected to start working in the mine early next year. More than 400 employees will be required when the mine becomes 100% operational. A large number of former New Acland Coal Mine Workers had shown interest - poten tially including Junior mining engineers who had previously been fired between 2019 and late 2021 when the reserves of coal were exhausted.

www.skillings.net | 5

Twelve years afTer The iniTial proposal, The conTroversial Acland Coal Mine extension has been given the green light to proceed. This development means additional jobs for the local economy.

Indian Government Accredits Thirteen Private Companies To Explore For Minerals

JOHN EDWARD

The Central Indian Government announced on November 8, 2022 that it had accredited thirteen private agencies to conduct mineral exploration in the country.

The goal of the Mines Ministry's privatization plan is to boost the economic potential of the mining industry and to open up new job opportunities. The Ministry aims to achieve the same by including more agencies in mineral prospecting.

“With the amendment of Mines & Minerals (Development & Regulation) MMDR Act in 2021, private agencies can also participate in exploration for the mineral sector after getting duly accredited by QCI-NABET (National Accreditation Board for Education and Train ing of the Quality Council of India). So far, 13 private agencies have been accredited and subsequently notified by the Central Govern ment," the Ministry declared in a statement.

Currently, there are twenty two government organizations actively engaged in mineral prospecting. Any private exploration agen cies who are interested will be “…required to obtain accreditation in accordance with the scheme and thereafter apply to the ministry for their notification under the second pro viso to sub-Section (1) of Section 4 of the Act," the Mines Ministry stated. The development is expected to speed up exploration and to increase the number of explored blocks available for auction.

Hiring Levels In The Mining Sector Expected To Increase

MARIE GABRIELLE LAGUNA

MARIE GABRIELLE LAGUNA

when compared To The same monTh lasT year, The proporTion of mining sector operations and technologies businesses hiring for future work-related positions increased, with 43.5% of the companies in the analysis recruiting for at least one such position.

T his latest figure was higher than the 40% of companies that were hiring for future work-related jobs a year ago, but it was lower than the 52.5% figure in the previous months of 2022.

In terms of the percentage of all job openings that were linked to the future of work, related job postings fell - with 2.4% of newly posted job advertisements being linked to the topic. This latest figure was higher than the 1.9% of newly advertised jobs that were linked to future employment in the same month a

year ago. Many researchers have detected the future of work as a key disruptive force that companies will face in the coming years.

Companies that excel in these areas and invest in them now are better equipped for the future business landscape and better equipped to deal with unforeseen challenges.

It is perhaps promising to note that mining industry operations and technology firms are currently hiring for future work positions.

6 | SKILLINGS MINING REVIEW December 2022

Mining Automation The Path To Sustainability

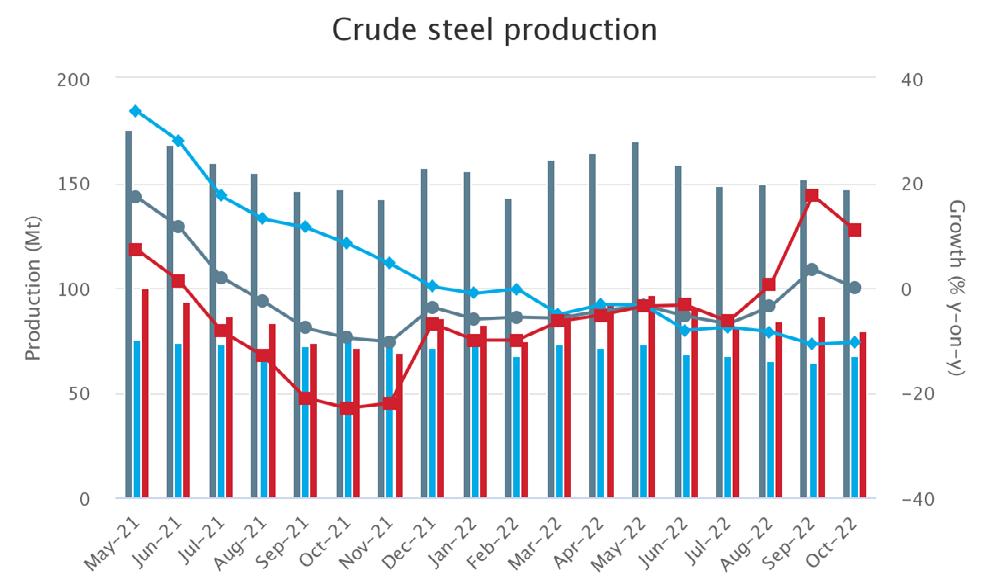

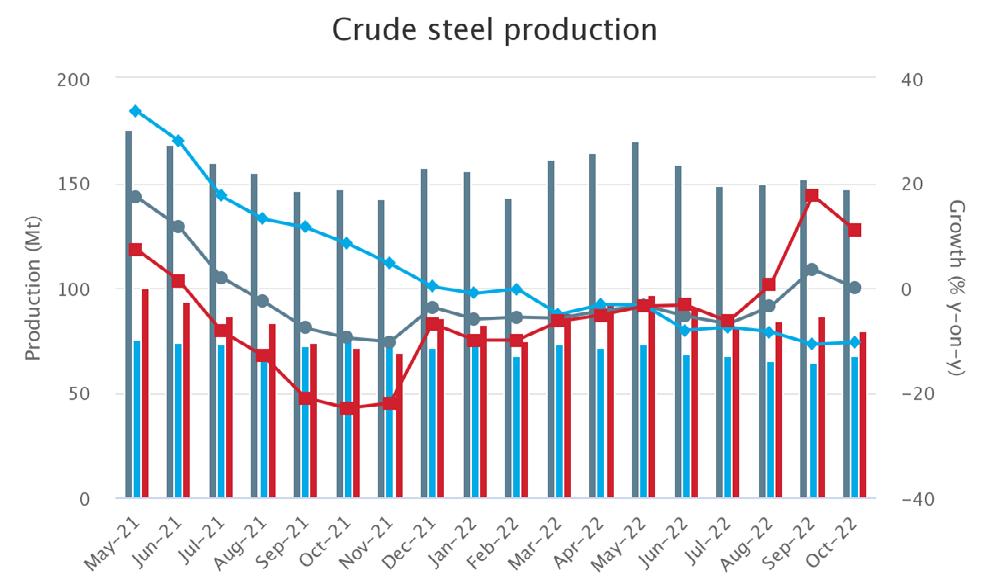

AALIYAH ZOLETA

It goes without saying that mining involves a significant amount of risk. Continuous improvements in terms of tech nology and machinery are needed to ensure that the competi tive demand of metals is met in a safe manner.

According to GlobalData’s Thematic Research, robotic technology is indispensable for any mining company which aligns itself with the goals of safety,

productivity and sustainability. Mining automation has increased the efficiency and productivity of different mines around the world. It has also helped to ensure the

safety of workers in the workplace while still maintaining low mine operating costs.

There are many instances where technol ogy has saved a large number of lives. For instance, in 2018, an over-pressurized water pipe was detected at the BHP Nickel West drill mine.

Together with the robotics expertise of Woodside and Deakin University, the com pany was able to cut the pipe without having

www.skillings.net | 7

someone go through the tunnel. The entire operation involved working with a robot from a safe distance as it was a risky affair. Because of the robot, the company was able to resolve the issue within two weeks.

Gudai-Darri: Three steps ahead

Rio Tinto launched their most technologicallyadvanced mine in 2022 in the Pilbara region of Australia. The company was able to optimize mine safety and productivity in terms of ore sampling and the distribution of parts needed for the mine.

Rio Tinto’s mine is expected to last 40 years with an annual production of 43 million tons. Together with Caterpillar, Rio Tinto will develop new autonomous water carts that will be used for dust suppression, assess road dryness, and dispense water automatically.

“We’ve worked closely with both the Banjima and Yindjibarndi People through the planning and development stages of Gudai-Darri and we look forward to partnering with them into the future to ensure the project achieves

significant social and economic benefits. Gudai-Darri represents a step-change in the deployment of automation and technology within our iron ore business and a fantastic demonstration of the talent, ingenuity and capability that exists in Western Australia, a region which is now known globally for its technical excellence and innovation,” said Rio Tinto Iron Ore Chief Executive Simon Trott.

Trott added, “Gudai-Darri's combination of data and analytics, machine learning and automation, will make this mine safer and more productive. Gudai-Darri is our first greenfield mine in the Pilbara in more than a decade and a multi-billion-dollar invest ment in the State of Western Australia that will operate for decades to come.”

There are a lot of different advancements and innovations in Gudai-Darri such as

8 | SKILLINGS MINING REVIEW December 2022 THE LEAD

Modern technology, expert analysis and digital solutions will help lower water and energy use and reduce waste–and FLSmidth and ABB can really move the needle in this area,” said Mikko Keto, Group CEO, FLSmidth.

trucks that have sensors that provide live dig face progression and accurate assess ments of existing ground conditions that help improve safety of the workers. They also have autonomous trains which will be used for transporting heavy equipment and different types of ore.

The company also has the first notable buc ketwheel reclaimer, a solar farm which consists of 83,000 solar panels, and paper less field mobility. The solar panels’ capacity is 34MW - enough to supply a third of the mine’s average electricity demand.

HeartCore signs with Transcosmos Digital Technology

HeartCore Enterprises recently announced their partnership with Transcosmos Digital Technology Inc. for the process mining tool

Apromore. HeartCore will mostly cater to Japanese enterprises and help with their digital transformation.

“We are pleased to sign a licensing agreement with TCDT, a company that understands the magnitude and importance of digital trans formation.Though the prevalence of process mining is in its nascent stage, the growing concern among business managers strug gling to optimize complex operations led us to pursue our initial exclusive reseller agree ment with Apromore in June of last year.

We intend to continue partnering with companies such as TCDT, as we expand our go-to-market efforts. We remain laser focused on leveraging our exclusive right to resell Apromore in Japan, as part of our own process mining service and plan to continue taking advantage of synergistic opportunities to scale our Digital Transformation initiative,” CEO Sumitaka Kanno (Yamamoto) stated.

ABB, FLSmidth to help mining companies de-risk operations

ABB and FLSmidth have joined forces to lower operating costs and ensure safety of laborers in the workplace. The agreement was finalized at the FT Mining Summit in London.

According to Joachim Braun, division president, ABB Process Industries, this col laboration is very important to the mining industry and will help achieve the targets outlined in the UN Paris Agreement. He also added that these two companies have chosen to work together during these times to help customers achieve their business goals and carbon-free operations that will benefit their workers.

“FLSmidth and ABB already have many of the building blocks for carbon-free, resource-op timized operations. By assessing how to combine and integrate these technologies and our respective expertise we will, together

with our customers, accelerate transition in mining operations. Mining is essential in the energy transition. Meanwhile, the mining industry is facing unprecedented challenges due to declining ore grade and high demand as it develops new sites, while also being asked to make existing operations more sustainable.

Modern technology, expert analysis and digital solutions will help lower water and energy use and reduce waste–and FLSmidth and ABB can really move the needle in this area,” said Mikko Keto, Group CEO, FLSmidth.

FLSmidth is known for providing sustain able productivity to the mining industry with market-leading technology and prod ucts that help their customers reduce their environmental footprint. The company introduced ‘MissionZero’ in a bid to make mining sustainable by 2023 in terms of technology, equipment, mineral processing expertise, automation, electrification and digital solutions.

www.skillings.net | 9

Mikko Keto, Group CEO, FLSmidth (left) shaking hands with Joachim Braun, Division President, Process Industries, ABB

Mining Projects in Latin America Face the Brunt of Inflation

JOHN EDWARD

JOHN EDWARD

in a worrying developmenT, mining projecTs across laTin america are stalling in the face of rising inflation and inflating production costs. An article published by Bnamericas stated that escalating inflation has hit mining projects across Latin America and driven costs higher. The extent of the problem can be gleaned from the fact that mining companies are being forced to ‘dig in’ to ensure continued impacts in 2023.

The Russian invasion of Ukraine has only worsened the problem by driving up the prices of natural gas, diesel, and energy. Mining companies have also highlighted that the steep increase in the cost of materials like equipment, tires, reagents, and steel have added to their woes.

Additionally, companies are also facing the brunt of rising labor costs in the aftermath of the Covid-19 pandemic. Inflationary pres sures have also led to spikes in shipping and freight costs.

10 | SKILLINGS MINING REVIEW December 2022 MINING FINANCE

Truck at Chuquicamata, world's biggest open pit copper mine, Calama, Chile.

“Cost inflation is definitely occurring across the [mining] industry,” opined Joe Bormann, Fitch Ratings’ head of Latin America corpo rate ratings. “At a general level, it’s happening to every company out there.”

What is more troubling perhaps is the fear that the situation might not get better any time soon. “As we look ahead, we expect that inflationary pressures and the impacts from a competitive labor market will persist into 2023, resulting in production levels and unit costs that will be similar to this year,” Newmont CEO Tom Palmer stated.

Needless to add, mining projects across Latin America are feeling the heat of the situation. In September 2022, Newmont pushed back a construction decision for the US$2.0bn Yanacocha Sulfides gold-copper project in Peru by two years to 2024.

The decision was taken after a review of the project scope. “As part of its review, Newmont considered the unprecedented and evolving market conditions, including the continued war in Ukraine, record infla tion rates, the rising prices for commodities and raw materials, prolonged supply chain disruptions and competitive labor markets,” the company said in a release.

The trend of rising capex estimates can be seen in other projects as well. On the basis of the current cost environment and estimate accuracy, Teck Resources and new JV part ner Agnico Eagle Mines said in September that development capex for the San Nicolás copper-zinc project in Mexico could go up to anywhere near the US$1-1.1bn range. This figure is significantly higher than the previ ously forecast US$842mn.

Elsewhere in Mexico, Torex Gold is expecting higher construction costs for its Media Luna gold-copper project. The project was esti mated at US$848mn in a March feasibility study in comparison to the US$496mn in a 2018 PEA.

According to Torex, the March estimate is, in part, a reflection of the current inflationary environment. “We want the project to be palatable to the market but we also want it to be credible, realistic, and something we can deliver on,” admitted CEO Jody Kuzenko in July.

Despite this worrying inflationary envi ronment, some companies have managed to keep their project costs in check. For instance, SilverCrest Metals is in the process of ramping up operations at its US$138mn Las Chispas silver-gold mine in Mexico.

The mine started production ahead of sched ule and was under budget in July. Similarly, Minera Alamos highlighted low-capex devel

opment in its Cerro de Oro PEA earlier in October. The project’s pre-production capital costs were pegged at US$28.1mn for an asset which is expected to produce 58,400oz/y gold over an 8.2-year mine life. The company president Doug Ramshaw had attributed the low capital intensity of the project, in spite of rampant inflationary pressures, to the com pany’s sound business model in a release.

All isn’t well however. Inflation has been tagged as the key driver in Pan American Silver’s decision to suspend underground operations at its Dolores gold-silver asset in Mexico. The company said in August that the decision came in the backdrop of a shortfall in grades which triggered an analysis for impairment.

Needless to add, mining projects across Latin America are feeling the heat of the situation.

www.skillings.net | 11

In September 2022, Newmont pushed back a construction decision for the US$2.0bn Yanacocha Sulfides gold-copper project in Peru by two years to 2024.

Rising costs have also pushed First Majes tic Silver to reduce its spending plans. The company focuses on silver production in Mexico and is pursuing the development of its existing mineral property assets.

First Majestic Silver presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, and the La Encantada Silver Mine.

Rising production costs have further exac erbated the problem. According to Chilean copper commission Cochilco, the higher production costs across the country’s copper assets are linked to global inflation and a reduction in output.

Chile happens to be the world’s top copper mining country. In a worrying development, cash costs of larger producers increased by US$0.183/lb in H1, compared to the same period last year, with 16 smaller operations seeing a much steeper rise, up US$0.542/lb.

These higher costs will eventually be passed on to consumers despite the fact that mining companies are likely to benefit from the strong prices of industrial and precious metals in comparison to historical averages.

Metals prices are increasing partly due to global shortages associated with slow proj ect development, mine disruptions, and growing demand.

It is important here to note that consumption of metals like copper and lithium is expected to increase significantly in the coming years with the increasing push towards renewable energy and electric vehicles.

“With the shortage of metals out there, most of those increases in price are going to be transferred on to the end users,” Bormann added. “Buyers out there are just going to pay for it and at the end of the day they are just going to push [rising costs] onto consumers.”

What Effects Will The Global Energy Crisis Have On Crypto Mining Markets?

here is no denying that the world is currently experiencing an unprecedented energy crisis. This crisis has been exacerbated by the COVID-19 pandemic and the Russian invasion of Ukraine. This has resulted in severe shortages and sharp increases in the price of oil, gas, and electricity in nations around the world – especially in Europe and North America.

Limited gas supplies have drastically increased the cost of necessities like fertilizer. In addition, they have also led to a greater reliance on coal and other natural resources. Europe alone had a 14% increase in coal usage last year and another 17% increase is anticipated by the end of 2022. European gas prices are currently approximately ten times higher than their average level over the previous ten years, hitting a record high of over $335 per megawatt-hour in late August. On a related note, the recently released winter fuel estimate for 2022 from the United States Energy Information Administration predicts a staggering 28% increase in average fuel prices for Americans over the current year, reaching a staggering $931.

With such alarming data available in the public domain, it is important to investigate how this prolonged energy deficit may impact the crypto industry and whether its negative impacts will abate any time soon.

Experts Weigh In On The Subject

The global economy is in bad shape according to Matthijs de Vries, founder and chief technical officer of AllianceBlock – a blockchain company that bridges the gap between decentralized finance and traditional finance. He recently told Cointelegraph that a number of factors – such as the power crisis, an impending recession, surging inflation, and rising geopolitical tensions – are to blame.

He added that, “These problems are connected, particularly in the way that capital enters and exits businesses that have an impact. The capital that flows into and out of the digital asset industry is negatively correlated with the macroeconomic environment. The blockchain’s incentivization processes can only function as long as there is this liquidity. Therefore, if there is a lack of liquidity, miners will have fewer transactions to confirm, lower fees, and fewer incentives.”

De Vries also thinks that rising energy prices may give miners greater motivation to switch to Ethereum 2.0’s validator ecosystem, which uses a proof-of-stake mechanism that is much more energy-efficient.

Even though the current energy crisis will have a considerable impact on miners, there is still some hope that the present macroeconomic circumstances will favor the crypto business.

T

12 | SKILLINGS MINING REVIEW December 2022 MINING FINANCE

HALCOR PRODUCTS

Copper tubes with or without lining or industrial insulation for applications in:

• Drinking water and heating networks

• Underfloor heating and cooling

• Gas and medical distribution networks gases

• Cooling and air conditioning systems

• Solar energy applications

• Various industrial applications

The copper segment of ElvalHalcor S.A. is composed of six subsidiaries and seven associates/joint ventures, based in Greece, Belgium, Bulgaria, Romania and Turkey, while it operates a total of five production plants in Greece, Bulgaria and Turkey.

The copper segment of ElvalHalcor S.A. develops and distributes a wide range of products, including copper and copper-al loy rolled and extruded products with Halcor being the sole producer of copper tubes in Greece. High quality in production

Halcor is the copper tubes division of ElvalHalcor S.A. and together with four more companies form the copper segment of ElvalHalcor S.A. that specializes in the production, processing and marketing of copper and copper alloys products with dynamic commercial presence in the European and global markets. For more than 80 years, Halcor has been offering innovative and added-value solutions that meet contemporary client demands in fields, such as plumbing, HVAC&R, renewable energy, architecture, engineering and industrial production.

is achieved through strict controls applied throughout the production process. With a consistent quality focus, the company implements an ISO 9001:2015 Certified Quality Management System and leverages high technologies and expert staff.

As a result of the Group’s strategic invest ments in research & development, Halcor is recognized as one of the leading copper producers globally, setting new standards in copper processing. The company main tains a consistent focus on quality and

environmental protection and a strong commitment to the principles of sus tainable development. In this context, all production facilities in the Group’s plants leverage advanced technologies to bring in the market innovative products that are energy efficient and environmen tally friendly.

For more information, please visit our web site www.halcor.com

www.skillings.net | 13

Deploying Artificial Intelligence To Help Fill The Short-Term Essential Minerals Gap

MARIE GABRIELLE LAGUNA

sofTware based sysTems ThaT use daTa inpuTs To decide for themselves or to assist people in making decisions are referred to as artificial intelligence (AI) systems. The use of AI will be crucial to the survival of businesses of all sizes and in all industries within a few years.

A part from growing environmental challenges, there are significant energy security issues in many parts of the world. This is taking place in the backdrop of rising energy costs, partly as a result of supply chain issues influenced by the ongoing crisis

in Ukraine. In Europe, where natural gas is heavily used for heating and cooking as well as the production of electricity, this effect is amplified. Thus, the market becomes more susceptible to supply shortages. Governments around the world are being

compelled to improve their domestic resilience and energy security through the provision of clean energy in order to protect consumers from significant financial effects.

Additionally, this is hastening a change in energy production to help limit global warm ing below 1.5 degrees Celsius.

Nevertheless, the demand for mineralsparticularly vital minerals like lithium, cobalt, copper, nickel, and graphite - is anticipated to rise significantly because of the energy tran

14 | SKILLINGS MINING REVIEW December 2022 SPECIAL FOCUS

sition. Predictions state that by 2040, there will be a four-fold increase in the number of key minerals needed for renewable energy technology.

For the mining sector, this is a breakthrough. However, the industry must develop new strategies to boost productivity and efficiency in order to meet rising demand and to close the supply gap.

In order to maintain its current permits and obtain new ones, the mining sector will also need to keep its environmental and climate footprints under stringent control.

The Landscape for Mining Businesses Using Artificial Intelligence

In the mining sector, AI is more crucial than ever due to declining yields and adverse environments. Every stage of the mining value chain - from exploration to extraction, processing, and even marketing - can be significantly impacted by AI.

With the potential to maximize ore pro cessing, AI is making systems smarter and capable of extracting more value from already-existing resources. AI can even benefit the environment by improving the remote targeting of rich mining resources. This results in the reduced need for pointless excavation which can be extremely harmful to the environment.

The Effects Data May Have

Every mineral processing facility has inefficiencies because of the intrinsic geological variability of the ore that these facilities deal with - irrespective of whether such a facility processes 50,000 ounces of gold annually or 400,000 tons of copper annually.

Even with mineral processing facilities working towards increasing productivity, the mining sector faces a number of diffi

culties including growing costs, fluctuating commodity prices, and variability in operating procedures.

Concerning the effect of mining on natural resources, there is another troubling factor. Roughly 3 billion tons of ore are extracted annually and the mining sector accounts for 10% of the energy utilized globally. Fur thermore, mining operations utilize over 4 billion cubic meters of water annually. The increasing demand for minerals and metals will only exacerbate the effect on our natural resources unless we take a dramatically different and climate-smart approach.

Miners use numerous systems and data bases to manage their processes in an effort to boost efficiency. However, the collected data remains vastly underutilized in a sig nificant number of cases. According to the findings of recent McKinsey studies, mining corporations only utilize less than 1% of the data collected by their equipment and tools. As a result, many petabytes of data are not utilized for operational decision-making and instead languish in silos.

www.skillings.net | 15

In the coming years, digitization may help close the gap between the supply and demand of essential minerals. A 3% to 5% boost in metal recovery utilizing AI applications would increase our potential to provide an extra 450,000 tons of copper annually, valued at $3.2 billion, according to the earlier estimates for copper mine production.

Excellence in Next-Generation Operations

Mining executives are increasingly using artificial intelligence (AI)-based technology to plan for future operations.

Digital twins, autonomous systems, and deep learning neural networks are a few of the technologies that reveal hidden correla tions between various process parameters to reveal hidden insights into process performance.

This is especially useful for the mining industry due to the dynamic nature of its processes, the challenging working environ ment that causes data loss and data quality problems, and the inherent geological uncer tainty linked to different ores.

When data is fully utilized, the deployment of an integrated physics-informed machine learning model (scientific AI) through a realtime software environment can uncover concealed insights, provide superior forecasts, and encourage efficiency improve ments through real-time optimization.

Scientific AI-driven software technologies can improve organizations' decision-making processes to deliver more significant busi ness outcomes when properly integrated into workflows that traditionally require human intelligence. It is important to note, however,

that there is no one-size-fits-all technological solution to solve every industry challenge. The improvements in communication are a fantastic illustration of how digitization may increase productivity. About 53% of the

energy consumed in mines is used in "the process of crushing and grinding ore." Using AI technologies for real-time monitoring and mill prediction has already demonstrated the potential to boost throughput while lowering

energy consumption. This is achieved by safely pushing equipment to its maximum operational capacity.

Effect of Efficiency on the Supply of Essential Minerals

Efficiency gains have a big impact on the mining industry. As an example, copper is one of the most widely used metals in the world with demand coming from a variety of sectors including renewable energy and building.

In the mining sector, AI is more crucial than ever due to declining yields and adverse environments. Every stage of the mining value chain - from exploration to extraction, processing, and even marketing - can be significantly impacted by AI.

16 | SKILLINGS MINING REVIEW December 2022

SPECIAL FOCUS

The top 20 copper mines in the world today have an annual production capacity of about 9 million tons.

In 2020, this accounted for 44% of global copper production. However, given that the demand is expected to rise by 31% between 2020 and 2030, this present source of supply simply won't be enough.

In the coming years, digitization may help close the gap between the supply and demand of essential minerals. A 3% to 5% boost in metal recovery utilizing AI applica

tions would increase our potential to provide an extra 450,000 tons of copper annually, valued at $3.2 billion, according to the earlier estimates for copper mine production.

This is the equivalent of the yearly output capacity of Peru's Las Bambas Mine - one of the world's top eight copper producers.

Improvements like these give an already strangled industry some breathing room, especially in light of the fact that "the average mine takes 15 years to bring into production." Millions of tons of minerals, including essen

tial minerals, are already needed to support a sizable transition to renewable energy for a low-carbon future.

The mining sector can boost productivity, cut waste, and avoid using energy from non-renewable resources by implementing next-generation AI-based software technol ogies such as scientific AI.

fryberger.com Equipping the mining industry with legal services since 1893. ›› Paul Kilgore ›› Paul Loraas ° MINING & MINERALS LAW ° ∙ Mineral purchase agreements, leases and options ∙ Land assembly and mineral rights acquisition ∙ Severed mineral registration and title work ∙ Environmental permitting and compliance

www.skillings.net | 17

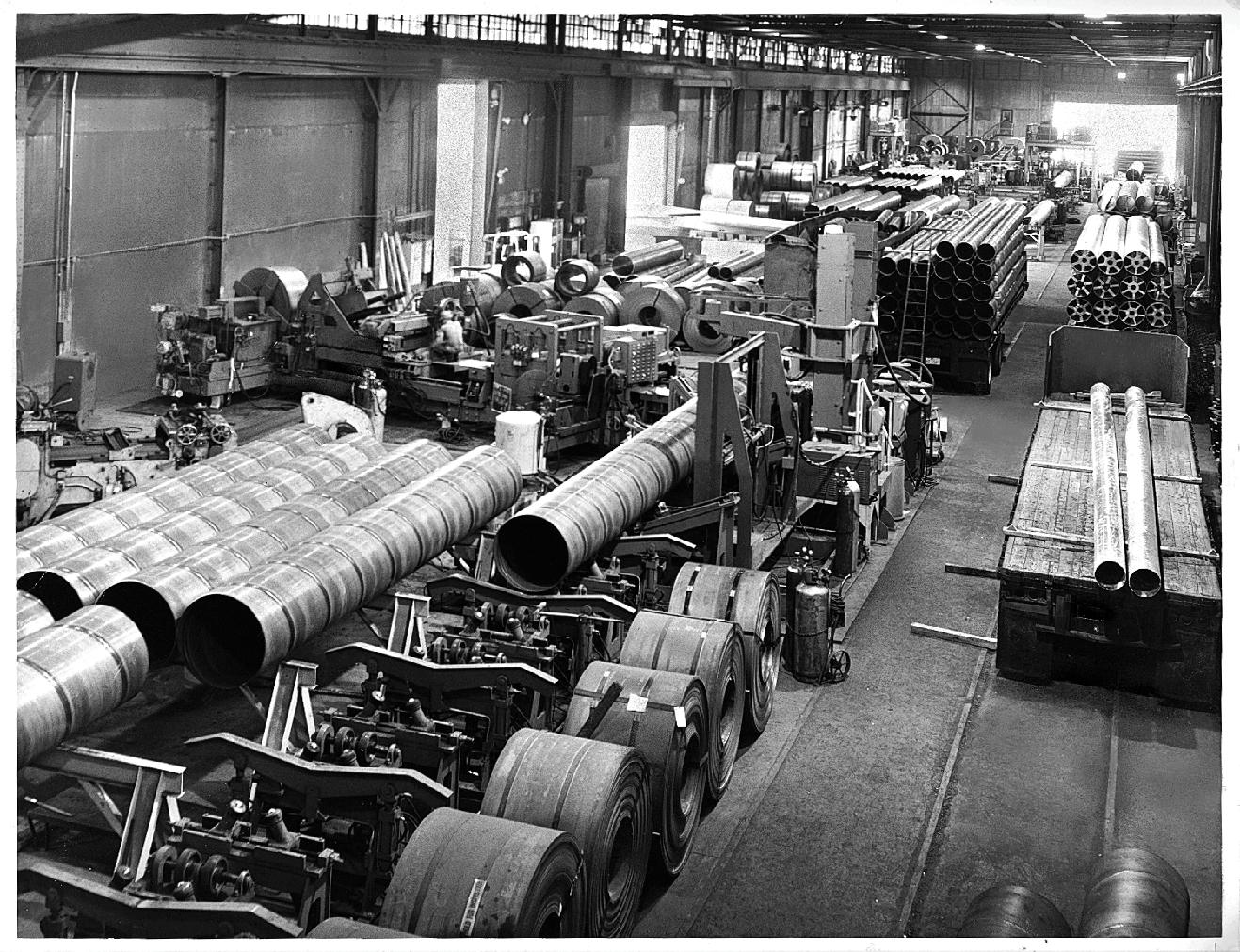

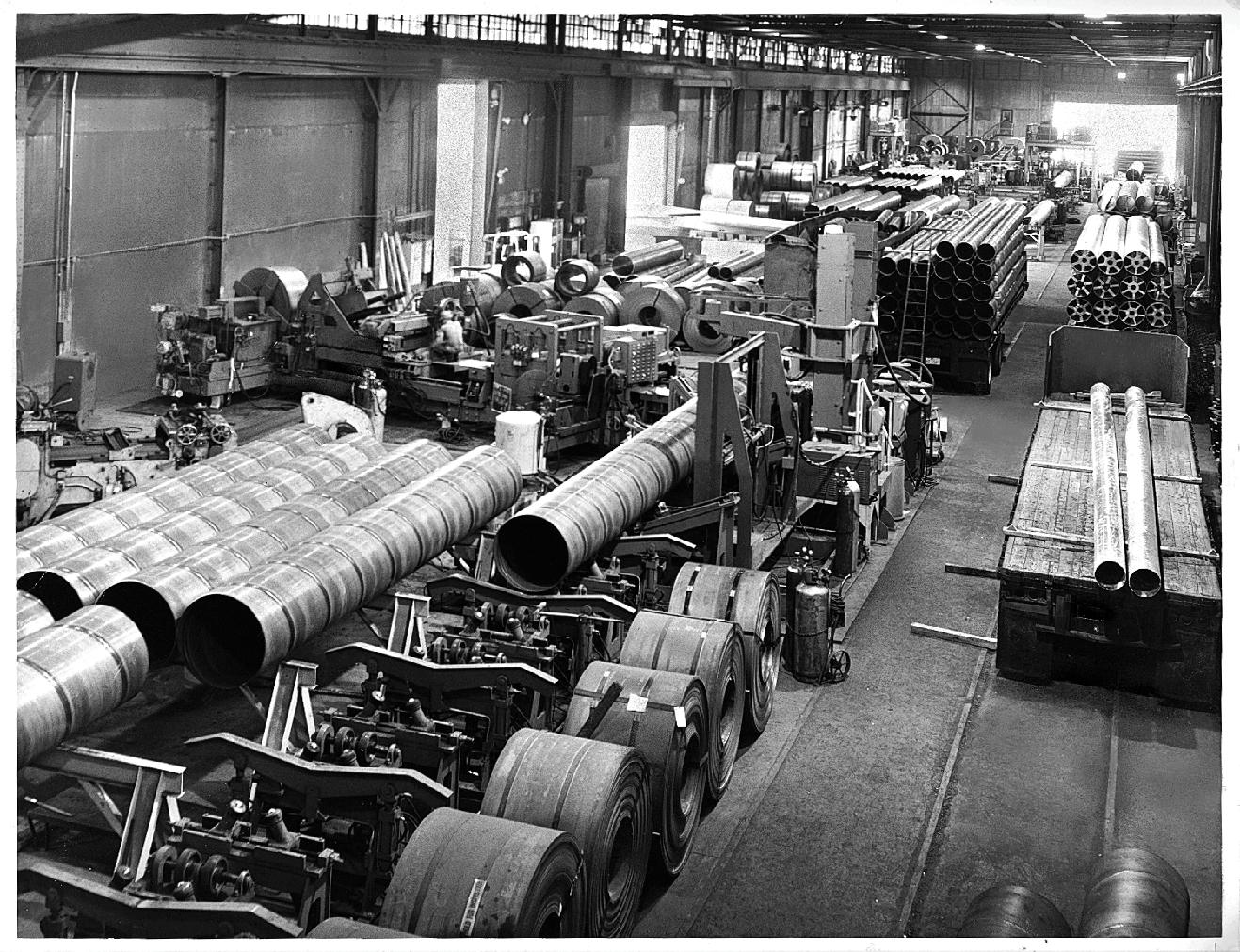

US Steel Iron Ore Could Bring New Boom

us sTeel is seT To produce TaconiTe pelleTs ThaT could poTen tially save the iron ore mining industry and create more job opportunities. For almost a century, Minnesota mines have produced iron ore not just for US Steel mills but also for other major corporations. These mills then turn ore, coal, and limestone into cast iron and eventually steel.

Kangas, Director of the Natural Resources Research Institute at Coleraine, part of the University of Minnesota. Duluth. “This is a huge step forward for Minnesota’s iron ore industry,” he added.

Cleveland-Cliffs, the most significant player on the Iron Range, is already producing highgrade iron ore pellets.

The future of the Iron range depends on whether these two major players, which have been associated with blast furnace steelmak ing, make it or not in this new industry. It is important to note that the mines found in this region have always been in the hands of their steelmakers.

“We are on Pins and Needles on the Rail Belt as the Steel Industry Turns Around [electric furnaces]. Are we going to be part of the long-term future of the steel indus try? That worries me,” said John Arbogast. Arbogast is the 11th district representative for the United Steelworkers of America, which represents workers at all but one of the state’s six taconite operations.

Minnesota’s taconite industry is still a pillar of the Iron Range economy despite having diminished from its prime.

In its heyday, this industry contributed about five thousand jobs. This figure may have dwindled to four thousand jobs but, on a positive note, has remained steady for the last two decades. The mining industry provides one of the highest-paying jobs in the country and the industry forms the Iron Range’s tax base.

ROBEL RAMOS

However, this process is becoming obsolete as cheaper and more energyefficient plants utilizing electricity and scrap metal become the new norm. Furthermore, as governments increasingly call for greener and cleaner alternatives, traditional steelmaking’s future is beginning to look a bit uncertain. The Pittsburgh-based company is

set to put in $150 million in its Keewatin plant. This plant produces high-grade iron ore to power electric furnaces or mini-mills. These mini mills create high-quality steel and need high-quality iron to supplement scrap metal.

“The biggest advance in modern iron ore processing technology is what’s happening right now in the Iron Range,” said Kevin

Keewatin mayor Mike LaBean said, “Mining is still the straw that stirs the drink.” LaBean was a miner until he lost his job in the early 1980s. Keetac, a site near Keewatin City Hall, is one of the many taconite sites in the area. It was built between the mid-50s and mid-70s and is the smaller of the two Iron Range mining and processing opera

18 | SKILLINGS MINING REVIEW December 2022 SURFACE MINING

tions owned by US Steel. Keetac has 400 workers and will continue producing tra ditional seeds. Taconite is about 30% iron and is mined from the Keetac site and then fed into a large crusher. The iron is culled from the pulverized ore using magnets. It is then molded with clay into smaller pellets containing approximately 66% iron.

In August, US Steel started expanding to take this process one step further. If Kee tac’s new wing begins operating by 2024, the facility will still produce new pellets with 68% to 69% iron. They will also have less silica as compared to traditional pellets

thereby making them more suitable for use in electric furnaces.

Mike Bakk, director of operational readiness at the iron ore factory in Minnesota said, “This is probably the most exciting thing that has happened in the Iron Range in 50 years.”

Electric furnaces are increasingly gaining a foothold in the industry. In the 1980s, electric furnaces gained traction - especially in the US where scrap metal is abundant. First, they produce low-grade steel products like rebar for reinforced concrete. However, the influx of newer technology prompted small-scale

mills to enter the premium steel market. By 2021, 71% of US steel production comes from electric furnaces - a 47% increase from 20 years ago. These figures come from Carnegie Mellon University’s Iron and Steel Research Center in Pittsburgh.

Traditional steelmaking’s share in the market has plummeted and the number of blast furnaces in the country has dipped from 60 in 1990 to 21 in 2021. Small-scale mills employ electrodes in order to melt scrap metal, together with pig iron and DRI or direct reduced iron, both of which are critical in making high-quality steel.

www.skillings.net | 19 Proud to be your reliable partner. We have long supported the region’s mining industry by providing safe, reliable and competitively priced electricity. In 2021, half of the energy we provide to all of our customers will come from renewable sources. Together, we power northeastern Minnesota’s economy. mnpower.com/EnergyForward 19260

A new “direct reduced” iron pellet from US Steel and Cleveland-Cliffs is being designed for use in DRI furnaces, creating a product with about 95% iron.

In the US, there are three DRI plants. One is owned by Cleveland-Cliffs and is located in Toledo, Ohio. This plant uses DRI for its electric and blast furnaces.

US Steel is contemplating disposing the reduced pellets directly to DRI manufac turers. They also plan to build their own DRI plant.

Kevin Lewis, US Steel’s vice president of investor relations, said, “It is not a matter of if, it is a matter of when and where it comes with DRI.” He also said US Steel “did not go into much site consideration for the DRI plant.”

The Iron Range would like to have a DRI plant and Cleveland-Cliffs has put in $1 billion in its DRI operations.

To produce grain for its DRI plant, Cleve land-Cliffs in 2019 shelled out $100 million in the North Shore taconite operations in Silver Bay. However, the plant and the Babbitt mine that supplies it has been decommissioned.

Steve Mekkes, senior engineer for the Min nesota Department of Natural Resources said, “You can’t judge the market for DR pellets based on what Cleveland-Cliffs is doing because they’re making their own internal business decisions.”

Electric furnaces will continue to benefit considering they are less harmful to the environment as compared to carbon diox ide-emitting blast furnaces.

“Most blast furnaces shut down because the CO2 concentration is so high,” said Chris Pistorius, a fellow at Carnegie Mellon’s Iron and Steel Research Center.

Career Prospects for Mining Engineers

BY ROBEL RAMOS

a loT of people sTill Think of TradiTional miners when They talk about mines and the mining industry. The truth, however, is that mining is more than just pickaxes, hard-hats, and getting down to a mineshaft on a lift to mine and haul gold, coal, and other precious metals.

The influx of modern technology has drastically changed how things work - especially in dangerous workplaces typically associated with the mining industry. These changes , however, have prompted industries to rethink their traditional practices. It goes without saying that organizations are adopting better and more modern strategies in order to ensure survival, growth, and productivity.

The rise of technology has also swayed companies to hire tech-savvy senior roles like planning engineers, machine learning engineers, geologists, and senior mining engineers to name a few. Technological advances have proven to be efficient thereby helping com panies reduce costs while increasing productivity.

In 2019, Market Intelligence discovered that companies with female CEOs saw an increase of 20% in stock price momentum. Diversity and inclusion in the industry are the future. For individuals trying to venture in this industry, the career path for mining engineers within the domain may differ but the future is bright.

Mining Engineer

Geology

Mining and Mineral Surveying

This professional is responsible for assessing the safety, feasibility and productivity of potential locations. They develop the design of the mine and also mining equipment. To be a mining engineer, one has to have a degree in one of the following: Civil Engineering Minerals Surveying Mine and Quarry Engineering

In case an individual possesses any of these degrees, a multitude of career paths open up including:

Junior Mining Engineer Mine Planning Engineer Senior Mining Engineer Mine Supervisor Resident Manager

MINING JOBS

20 | SKILLINGS MINING REVIEW December 2022

Biden-Harris Administration Announces More Than $109M Support To Create Jobs

BY JOHN EDWARD

The Biden-Harris Administration announced a $109.48 million plan as part of President Biden’s Bipartisan Infrastructure Law intended to create “goodpaying union jobs” and to “catalyze economic opportunity” on November 15, 2022. The aforementioned goals will be achieved by reclaiming abandoned mine lands (AML)

in Alabama, Illinois, Iowa, Kansas and New Mexico. The Department of the Interior has made $725 million available to 22 states and the Navajo Nation in fiscal year 2022. More than $533 million were announced in awards in October for Kentucky, Maryland, Ohio, Pennsylvania, Virginia and West Virginia. Funding will be awarded to additional eligible entities on a rolling basis as they apply.

“Through President Biden’s Bipartisan Infrastructure Law, we are making a once-in-a-generation investment to clean up environmental hazards that are harming local communities,” said Secretary Deb Haaland.

“Reclaiming and restoring these sites will create jobs, revitalize economic activity, and advance outdoor recreation. I am so excited about what we can do with these new resources, today and for future generations.”

It is important to note that millions of Americans live within just one mile of an abandoned coal mine or orphaned oil and gas well across the country.

SOLVING YOUR MOST COMPLEX CHALLENGES. With SEH, you are a true partner and collaborator. Engineers | Architects | Planners | Scientists 800.325.2055 | sehinc.com/subscribe

www.skillings.net | 21

Mines To Create 4,000 New Jobs in Zimbabwe

BY JOHN EDWARD

In an article for The Sunday Mail, Oliver Kazunga opined that mining companies were expected to create four thousand jobs in Zimbabwe thanks to US$1 billion capital expenditure programs in the sector.

According to the Chamber of Mines of Zim babwe, this projected growth represents an increase of 9 percent in new formal employment from the current figure of approximately 45,000 workers in the sector.

The mining industry is one of Zimbabwe’s key productive sectors and is responsible for bringing in 73% of foreign direct investment into the country. It also accounts for 83% of exports, 19% of government revenues, 2% of formal employment, and 11% of individual incomes. Keeping in mind the industry’s significance to the economy, the Second Republic - under

President Mnangagwa in 2019 - had launched a US$12 billion mining economy target to be achieved by 2023.The envisaged milestone will depend upon increasing production through expansion projects, reopening of closed mines, and the launch of new projects. By the end of 2022, the mining sector is expected to grow to a US$8 billion economy as compared to US$5.3 billion last year.

Growth of Oilsands Mine in Recruiting Female Equipment Operators

MARIE LAGUNA

'The more equal we feel ouT here, The nicer iT is for all of us,' says Robin Hebbard.Robin Hebbard was one of the handful of women who worked as heavy equipment operators and simulator trainers at Syncrude's Aurora mine in 2007.

Female workers now account for roughly 30% of the workforce at the Aurora site. The increase was most noticeable in the locker room, which had 135 lockers and 180 women. "We saw two to three women per locker," Hebbard explained. She raised the issue with her director, and the corporation switched one of the men's locker rooms with the smaller women's locker room in December, freeing up 213 lockers. "It's really great to have a remedy to the issue and a space for all the women to feel comfortable," she said. "The more equal we feel out here, the better it is for all of us."

Hebbard credits the success of the Aurora site to programmes such as Women Building Futures, which provides support services to assist unemployed and underemployed women in discovering different careers. Women Building Futures collaborated with the Aurora site to recruit and support female heavy equipment operators, according to Thomson. Careers The Next Generation is also working to increase the number of women working in trades.

ArcelorMittal Creates Jobs in Liberia

With one of the best paying rates and consistent investment in programs that enrich its staff’s working experience, it comes as no surprise that ArcelorMittal’s workforce is growing steadily in Liberia.

In an article for GNN Liberia, Cholo Brooks opined that ArcelorMittal was a top-rated employer in Liberia. The company has nearly 3,000 employees and contractors in the country, out of which 95% are Liberians.

Partly owned by the Liberian Government, ArcelorMittal Liberia benefits the country on many fronts, including job creation, revenue generation, socio-economic development, and community development projects. Investing in the country and sharing the values of the communities where it operates are important priorities for the business.

MINING JOBS

22 | SKILLINGS MINING REVIEW December 2022

www.skillings.net | 23 FloLevel Technologies

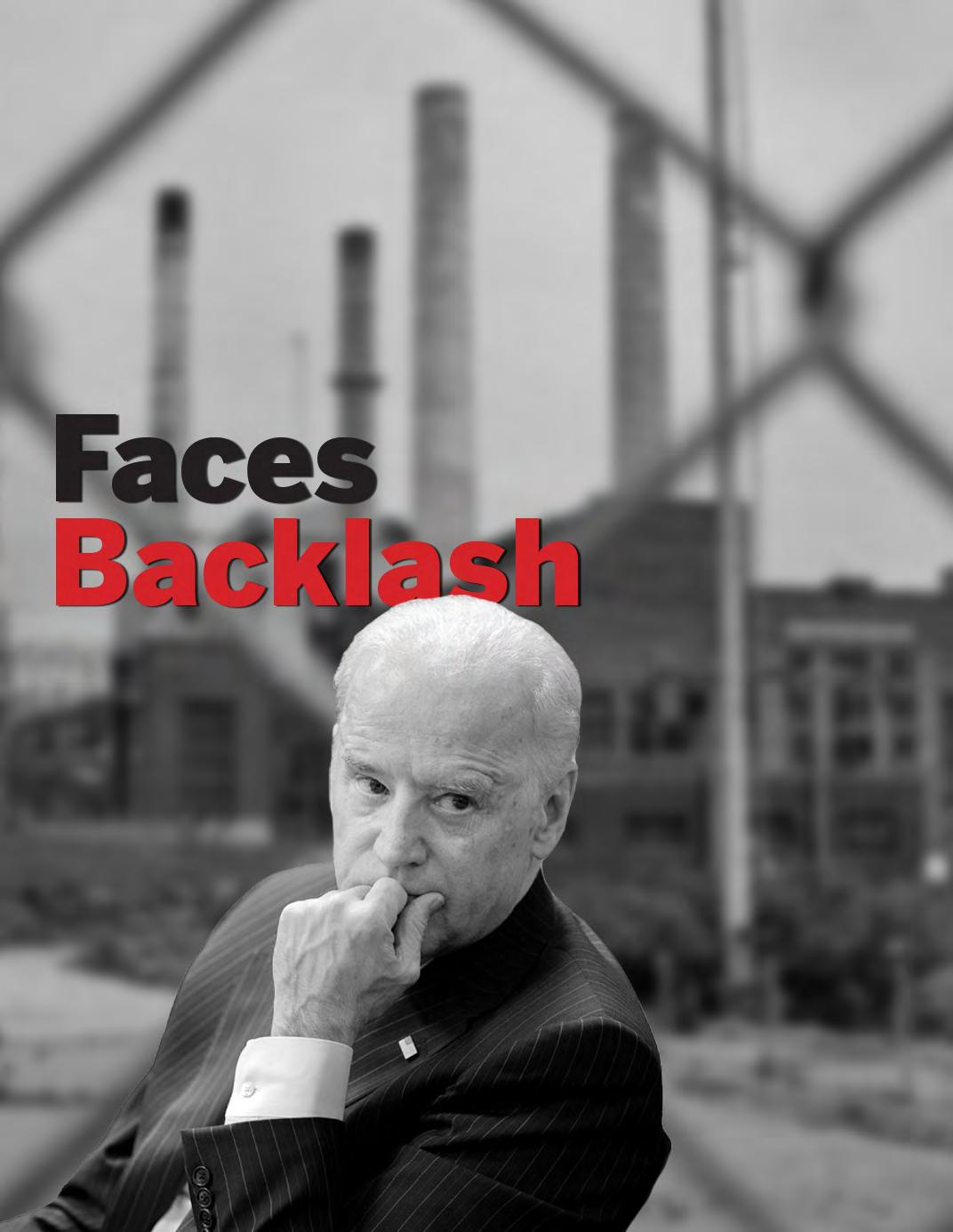

Biden Says Coal Plants ‘Across America’ Will Be Shut Down

JOHN EDWARD

The White House scrambled to clarify President Biden’s declaration that an energy transition would mean shutting down coal plants. In an article for Bloomberg News, Anna Edgerton and Jennifer A. Dlouhy reported that the White House sought to reframe President Joe Biden’s comments on closing coal plants as part of a US “energy transition.”

On November 4, 2022; Biden had declared that coal plants were simply too expensive to operate. He had further added that he was inclined to shut “these plants down all across America" in order to transition towards more renewable sources of energy.

"I was in Massachusetts about a month ago on the site of the largest old coal plant in America," Biden mused at an event in Carls bad, California. "Guess what? It cost them too much money.

They can't count. No one is building new coal plants because they can’t rely on it. Even if

they have all the coal guaranteed for the rest of the existence of the plant.”

"So it's going to become a wind generation. And all they're doing is it’s going to save them a hell of a lot of money and using the same transmission line that they transmit ted the coal-fired electric on, we're going to be shutting these plants down all across America and having wind and solar power, also providing tax credits to help families buy energy efficient appliances, whether it's your refrigerator or your coffee maker, for solar panels on your home, weatherize your home, things that save an average, experts say, a minimum of $500 a year for the average

family," he added. Biden’s comments drew almost immediate criticism from different quarters including the mining industry and West Virginia Senator Joe Manchin.

The latter called the remarks “outrageous and divorced from reality.” The situation is particularly delicate because the US is days before midterm elections with Democratic congressional majorities at stake.

Republicans were also quick to criticize Biden for pursuing an energy policy that could cost American jobs. “We know how this ends,” Representative Steve Scalise, Republican of Louisiana, said on Twitter. “People lose their livelihoods. You pay more for energy.

A Department of Energy report published this summer had indeed shown massive job losses in the fuel industry. The annual U.S. Energy and Employment Report (USEER) stated that the coal industry lost 7,125 jobs in 2021 which reflected a reduction of 11.8% year-over-year.

24 | SKILLINGS MINING REVIEW December 2022 UNDERGROUND MINING

The backlash came just as the President was about to campaign in Pennsylvania which is a coal-rich state and has a long history as both a producer and user of the fossil fuel. Pennsylvania is also the battleground of a closely fought Senate race that could potentially determine control of the chamber. The neighboring states of West Virginia and Pennsylvania are the second-largest and third-largest coal-producing states in the US respectively.

White House Press Secretary Karine JeanPierre said in a statement that Biden’s comments “have been twisted to suggest

a meaning that was not intended” and that the President “regrets it if anyone hearing these remarks took offence.”

Jean-Pierre also went on to state that Biden recognized that coal had long powered the US economy. She also highlighted that Biden had worked with Manchin to bring jobs and federal funds to regions hit by the transition away from fossil fuels. “No one will be left behind,” assured Jean-Pierre.

However, the damage may have already been done. “Being cavalier about the loss of coal jobs for men and women in West Virginia

and across the country who literally put their lives on the line to help build and power this country is offensive and disgusting,” Senator Manchin said in a statement on November 5. He called for a public apology and declared that it was time that Biden learned “a lesson that his words matter and have consequences.”

The United Mine Workers of America also jumped to defend the coal industry’s role in the energy transition and in develop ing technology which would lower coal’s carbon footprint. UMWA President Cecil Roberts stated that Biden’s comments were

www.skillings.net | 25 Industrial General Contractor Specializing in Equipment Installation and Maintenance crmeyer.com 800.236.6650 Offices: Byron, GA Escanaba, MI Muskegon, MI Coleraine, MN Tulsa, OK Chester, PA Oshkosh, WI Green Bay, WI Rhinelander, WI Millwrighting Piping Ironwork Concrete Electrical Building Construction Design/Build Offices Nationwide l l l l l l l Boilermaking l

“disheartening”. He went on to invite the President to visit communities in West Vir ginia, Pennsylvania, and Kentucky that had been impacted by coal plants shutting down.

“It’s easy to talk about ending an industry that supports hundreds of thousands of jobs in Appalachia and the Midwest, but the reality of such an action is harsh,” Roberts declared in a statement.

For his part, Rich Nolan - Head of the National Mining Association - said that Biden’s com ments were “completely incompatible” with energy-driven inflation. Furthermore, he stated that the statements were not in tune with the needs of the electric grid in many parts of the US. Any action that contributes to the global energy crisis would be “reckless and unthinkable” he opined.

It is important to note that Manchin isn’t up for re-election this year. He also happens to be a rare Democrat who represents pri marily conservative constituents. Manchin had previously emerged as a key vote in the evenly split Senate when he helped to pass Democrat-only projects such as the Inflation Reduction Act. This was after he had initially blocked Biden’s Build Back Better tax-and-spending plan.

Manchin has come under fire recently from parts of the Democratic Party for holding up policy priorities and for refusing to end the filibuster which depends on a 60-vote majority to pass most bills. On November 5, his frustration with Biden boiled over as he publicly questioned the President’s credibility.

“Comments like these are the reason the American people are losing trust in Pres ident Biden,” Manchin said in a statement. “It seems his positions change depending on the audience and the politics of the day.”

Western Lenders Restrict Financial Services to Coal Miners

ROBEL RAMOS

when iT comes To mining, especially coal mines, now is boTh the best and the worst of times for coal miners. After years of steady decline, the demand for coal has finally made solid breakthroughs as Europe scrambles to find an alternative to Russian gas.

With the prices of coal hitting record highs, one would expect companies to expand their operations. However, projects are being either shelved or left behind as Western banks stand by climate pledges to restrict lending to the coal miners sector. The Chief Financial Officer at the Australian coal miner Coronado Global Resources Inc., Gerhard Ziems, said, “If you are a business with a bank right now, it is easier. If you want to build a new mine, forget it; that has become impossible.”

The lower-value thermal coal typically used in power plants traded above coking coal for the first time in June. Ziems added that this was a crazy scenario – akin to silver trading at a higher price than gold. Benchmark Australia Newcastle thermal coal was suffering at $50 per ton at the start of 2020 before spiking above $150 per ton at the start of 2022. Thermal coal further hit a record high at more than $400 per ton in September as countries tried hard to replace Russian gas.

However, with most Western banks under pressure from shareholders to stay true to their commitment to climate change, coal miners say they are having a hard time scouring for alternative financial backing to take advantage of the scenario.

For some mining companies, it has become difficult to even find a lender for simple financial assistance. Shortly after North American miner, Ben Creek Group was listed on London’s AIM in October 2021, Lloyds Banking Group withdrew its banking services to the company due to a change in policies related to fossil fuels.

The banking company said that it would stop financing miners that generate more than 5% of their revenue from thermal coal by the end of 2022. Managers of Ben Creek suffered from the rejection and had to wait for months before they were able to open an account at the State Bank of India’s branch in Britain, CEO Adam Wilson said to Reuters.

The chief executive of Ben Creeks said that no company had these problems five years ago. Lloyds did not provide any comments on individual client relationships. It is a similar scenario for Minergy Limited – a startup company listed in Botswana. The company is looking for a financial institution to fund its expansion projects.

26 | SKILLINGS MINING REVIEW December 2022 UNDERGROUND MINING

US Mines More Coal In The West, But The East Employs More Workers

The annual coal reporT by ajoT revealed ThaT abouT 60% of coal was produced in the western part of the United States in 2021. However, only 28% of workers in coal mines worked there. The differ ence is due to the technologies employed in the East and West - surface mines in the latter use massive mining equipment and machines to extract a large amount of coal using fewer workers.

BY ROBEL RAMOS

The report separated the US into two regions, East and West, divided by the Mississippi River. Before the 1970s, most of the coal in the country came from the East. However, starting in the 1970s, the production of coal started expanding in the West due to the following reasons:

New emissions laws and regulations

New large-scale surface mines at the Powder River Basin in Wyoming, and other areas in the West.

Lesser freight rail shipping costs. It is important to note that coal is basically used for electricity generation in the US. However, the Clean Air Act of 1970, and subsequent amendments in 1977 and 1990, restricted sulfur emissions from power plants powered by coal.

In order to meet the regulations, these power plants have to burn low-sulfur coal which is normally found in the West. This resulted in an increased demand for low-sulfur coal,

especially in the Powder River Basin. In 2021, coal mine workers in the West produced 16 tons of coal every hour, significantly higher than their counterparts in the East where workers produce only 4 tons per hour of coal.

The difference can be attributed to the size of the coal mines in the West which are often large, open-pit operations that tap thick coal seams close to the surface. This lets miners from the West utilize super-sized draglines, shovels, and monster trucks, allowing com panies to extract and haul more coal with relatively fewer workers.

In the East, mines are smaller, underground operations with thinner coal seams which are often deeper and more difficult to extract. And despite deploying advanced technology like the longwall mining systems, mines in the East are not only laborious and toilsome compared to their western counterparts, they also have a lower productivity rate.

The new business environment in the rail road industry following the country’s railroad deregulation prompted railroads to inno

vate and utilize dedicated unit trains that typically load a single commodity directly to its destination. These unit trains let coal from the western side be transported in an economical manner to power plants all over the US.

Coal production in the United States peaked at about 1.2 billion tons in 2008. Since then, the production of coal has slipped significantly as the country sways towards natural gas, renewable and green energies for electricity generation. In 2021, the country managed to produce 577.4 million tons of coal, which is less than half of the amount it produced before.

Aside from coal production, employment in the coal mining business has also dwin dled. Most of the jobs that were cut were in the East. Since 2008, coal mining employ ment fell by:

59% in the East, down from 68,605 workers in 2008 to just 28,314 employ ees in 2021

39% in the West, dropping from 18,114 employees in 2008 to about 11,115 employ ees in 2021

Brief 2021 Highlights of US Coal Performance

In 2021, US coal production went up by 7.8% year over year to 577.4% million short tons or MMst. However, total productive capacity slipped to 871 MMst, a decrease of 6.6% from the previous year's level.

www.skillings.net | 27

Implementing ESG During A Recession

BY MARIE LAGUNA

The mining and metals sector, which was previously demonized in discussions about environmental sustainability, is now recognized as a vital component of the solution. Investors and consumers are becoming more aware of the industry's importance as a supplier of essential raw materials for the global energy transition as well as an important stakeholder in the value chain.

The way mining and metals corporations position themselves in anticipation of the energy transition, especially in light of a

potential recession, will determine their viability and might make or break their competitive edge over the course of the next ten years. Boards should think about how to strengthen current environmental, social, and governance (ESG) frameworks to make sure that they are resilient against the potential economic realities of the future.

To achieve this, it is critical to ensure that ESG is fully included in the long-term busi ness strategy as means of contributing value as opposed to an optional expense to be eliminated.

Evaluating The Resiliency Of ESG In A Recession

ESG is likely to be an important area of concern for stakeholders during a potential recession. ESG investing, according to a recent article in The Economist, "is a dysfunctional system [that] needs urgent repairs." Nevertheless, it aims to hold "firms and their owners accountable for their negative externalities."

high-profile ESG engagement priorities of BlackRock and State Street, along with the more than 5,000 investors who have signed

The

28 | SKILLINGS MINING REVIEW December 2022 SPECIAL FOCUS

As part of the energy transition, mining and metal corporations have started placing a greater emphasis on upgrading their environmental, social, and governance credentials. But will they be able to stick to their promise as a worldwide recession approaches?

the Principles of Responsible Investment, serve as evidence of the depth and breadth of investor commitment in this area. Related proxy voting and activism trends also serve to highlight this commitment.

Risks and opportunities can both be pro duced by ESG variables. For some time now, boards in the mining and metals sector have been working to address a wide range of ESG issues such as how to reduce greenhouse gas emissions and energy use, the working conditions in supply chains, tailings man agement, worker and community health and

safety, and adherence to ever-increasing reporting requirements.

However, during a downturn in the economy, leaders will need to choose which of these themes to emphasize, specify the goals to be met, and outline the anticipated timelines—all against the backdrop of unpredictability in the market and the economy.

Many people continue to believe that choos ing a more sustainable future requires making a trade-off between attaining cor porate growth and profit. They consider

ESG-related expenditures - such as capital costs for energy-use reduction, choosing renewable energy, paying living wages and so on - to be just costs rather than investments.

Companies will face intense pressure to handle ESG factors while maintaining quar terly expectations both before and during any recession. Boards must make sure gover nance standards continue to be in line with market realities because the greater the challenge an executive team has, the more tempting it is to take shortcuts.

Is ESG Mandatory Or Optional In The Mining And Metals Industry?

A rising corpus of research is revealing how important it is to take ESG issues seriously in order to increase resilience, long-term business performance, and investment returns. Businesses with high ESG credentials can outperform their peer groups and the general market.

Mining and metals businesses are investing extensively in efforts to cut emissions or meet other goals in the hopes of seeing a return on their investment in the future. Decarbonization investments, for instance, need high upfront capital expenditures but these might be compensated by tax breaks and enticing financing arrangements. Decar bonization initiatives can also increase energy efficiency which has a direct bearing on operating costs and margins. They also lower the possibility of adverse stock price ramifications or regulatory penalties.

Net-zero targets and the energy transition will fuel demand - and tremendous annual growth in market value - for metals and essential minerals like nickel, lithium, and copper. These factors will also drive demand for energy transition technologies and min erals. ESG drivers - including solid social licenses, appropriate divestitures, and tax transparency - will all be crucial for a com

www.skillings.net | 29

pany's sustained success as the transition to net zero will demand more mining, not less. A worldwide economic downturn could lead to increased cost-cutting initiatives in mining and metals thereby affecting both operations and capital expenditures at a time when further investment commitments are needed to satisfy rising ESG expectations from dif ferent stakeholders. Chief financial officers are under pressure to manage businesses' capital spending plans as they venture into uncharted terrain by allocating funds to initiatives with hefty price tags, protracted timelines, and often elusive returns.

The difficulty of achieving the ideal balance is increased by the fact that businesses fre quently make these investments before new legislation is put forward or before consumer preferences alter. From a financial standpoint,

it involves striking a balance between nec essary spending and possible losses brought on by ignoring or improperly managing ESG aspects. ESG is now the minimum operating standard, particularly in the mining and metals industry. It is no longer optional or a source of differentiation.

It is crucial for the company to align its strat egy to ESG priorities as part of its overall

business strategy through annual reports, proxy statements, sustainability reports, or other public materials after the management determines the appropriate level of corporate investment in ESG.

A Consistent Focus On "E"

Fifty-nine percent of investors, according to the 2022 Accenture Global Institutional Investor Study on ESG in Mining, want miners to pursue decarbonization aggressively and be industry leaders in this endeavor. In the mining and metals sector, almost 63 percent of investors said they would be prepared to sell their holdings in mining companies that fall short of their decarbonization goals or don't undertake enough decarbonization initiatives.

According to this report, mining and metals investors assess "essential" environmental projects as those that reduce scope three emissions, aiming for carbon neutrality by 2050, produce energy-critical metals, and produce no coal. Seven out of ten of the main mining and metals corporations pub licly stated that they wanted to be carbon neutral by 2050.

Other pertinent variables included diver sifying the board, management, and staff; investing in cutting-edge technology and dig italization; and having a great safety record.

By switching from "take, make, and waste" to "take, make, recover, and reuse," core revenue will be improved, and the value of end-of-life materials will be maximized.

SPECIAL FOCUS

30 | SKILLINGS MINING REVIEW December 2022

Risks and opportunities can both be produced by ESG variables. For some time now, boards in the mining and metals sector have been working to address a wide range of ESG issues such as how to reduce greenhouse gas emissions and energy use, the working conditions in supply chains, tailings management, worker and community health and safety, and adherence to ever-increasing reporting requirements.

Recycled resources will go down the cost curve, lowering supply costs and providing insurance against fluctuations in the price of raw materials. Likewise, businesses can leverage their circularity procedures to draw in clients who are concerned about the environment.

Companies are finding it harder to get fund ing if they don't have a systematic plan for closing significant ESG gaps or if they can't demonstrate any real results. This may also make it difficult to enter the stock market, secure licenses or insurance, recruit employ ees, or keep one's social license to operate.

For instance, mine development projects must include ESG and sustainability best practices at every level, from planning to mine decommissioning, as well as through out the supply chain, in order to be bankable. If they are unable to persuade investors that ESG remains a priority, mining and metals companies may also find it difficult to obtain other sources of funding during a crisis.

The Significance Of "G" During A Recession

For succeeding with ESG, solid and creative corporate governance approaches are essential. ESG must be integrated into corporate processes and structures in order to meet set objectives. In this approach, ESG should be viewed as a source of value addition and competitive advantage rather than a risk that needs to be managed or an expense that needs to be cut.

In a downturn, good governance is espe cially important. Alberto Calderon, CEO of AngloGold Ashanti, has declared: "Improv ing operational performance and regaining cost competitiveness against our counter parts provide greater value for us in the medium term."

Focus has shifted from ESG compliance and reporting to stronger commitments with

quantifiable goals and increased reporting openness. Increased regulatory compliance requirements, such as those set forth by the Task Force on Climate-Related Financial Disclosures, have also played a significant role towards this end.

Additionally, mining and metals corpora tions want to switch their reporting from a broad corporate level to a more detailed mine-site level. According to a Responsible Mining Foundation analysis that examined 38 large-scale mining corporations, few mining companies have truly incorporated the UN Sustainable Development Goals into their business strategy, even though many of them reference them in their sustainability reporting.

Reduced business risks related to an orga nization's ESG footprint might lessen the possibility of regulatory expenses, reputa tional harm, or loss of the social license to operate. The destruction of historic Aboriginal heritage sites in Australia and the deadly dam collapse in Brazil are two examples of how the latter can have a detrimental influence on shared values.

Furthermore, focusing on the "G" and main taining ESG as a top board agenda item,

particularly during a recession, can aid in managing costs, enhancing stakeholder engagement, diversifying supply chains, enhancing performance in comparison to peers, and aiding in the "war for talent" in order to build a sustainable and resilient company. Mining and metals firms can strengthen their balance sheets, experi ence more stable values, and make better long-term investment decisions.

An Essential And Continuous Journey

Inevitably, ESG considerations will alter the business environment for mining and metals industries. A company is unlikely to thrive if it permits itself to become an ESG laggard, especially if peers are setting the bar high.

ESG projects may experience some shortterm erosion during an economic downturn as companies look to cut expenses. Still, over the long run, the focus on ESG concerns will only be revitalized and strengthened. All stakeholders must place their ESG strategies front and center, with the same focus paid to ESG as to the extraction of minerals, if the mining and metals sector hopes to be recognized as a leader in the effort to reach net zero and complete the energy transition.

www.skillings.net | 31

Epiroc Agrees to Acquire Mining Automation Company RCT

BY ROBEL RAMOS

RTC, an Australian company based in Perth, provides an array of automated solutions for either a single machine or an entire mixed fleet of machines. The company offers mining automation and remote-control solutions to the global mining industry.

The acquisition will usher the company to become a “world-leading mining automation solutions provider,” for unloading, loading, and haulage apart from surface and under ground rock drilling.

Currently, RCT has customers in more than 70 countries. The company offers data and information systems, fleet and machine management systems, and machine pro tection systems.

In August 2022, Epiroc announced that they had acquired RNP Mexico. They also said that they would be acquiring mining equipment manufacturer AARD in September 2022.

In a statement, the President and CEO of Epiroc, Helena Hedblom said, “mining auto mation is increasingly important for the mining industry to strengthen safety and productivity, and RCT’s advanced solutions complement Epiroc’s existing automation offering well. Together we will provide com plete mining automation and remote-control

32 | SKILLINGS MINING REVIEW December 2022

Mining expert Epiroc gave the green light to acquire mining automation company Remote Control Technologies Pty Ltd (RCT) and is expected to complete the deal later this year.

MINING TECHNOLOGY

solutions to support our customers on their journey towards optimal operations.” “We are especially pleased that Bob Muirhead, RCT’s founder and a true pioneer within mining automation, will continue in an active management role. We look forward to wel coming the strong RCT team to Epiroc,” the statement stated.

In October 2022, Epiroc launched a new long-hole production drill rig for medium to large-sized drifts designed to provide increased mining automation and high-qual ity drilling. This is the company’s initial step towards its optimization program.

Mikael Larslin, the company’s Global Product Manager of Production Drilling said, “The connected Simba E70 S provides us with performance and quality data, so we can take the first step towards providing tailored process management to our customers.”

Navtech Radar aims to reduce “single point of failure” problem in minining automation

Navtech Radar’s Sam Wood said that banking exclusively on one sensor-based technology for autonomous operations of vehicles is a risk that most mining companies cannot afford to take.

Wood, the Product Manager of Navtech Radar, also said that the issue of operational continuity is likely to become evident in 2026 when an anticipated solar excitation event pushes a lot of GPS-based systems offline. Wood talked to IM on the sidelines of the recent Bauma 2022 fair in Munich, Germany. This event showcased the Amer ican company’s Terran360 single-sensor radar localization solution.

According to Navtech, their machine lever ages the company’s millimeter wave radar technology to reliably position a machine in its surroundings especially in working conditions that are often harsh - like mining and construction. While the Oxford-based

company is well-invested in providing radar-based solutions, the organization is also focusing on integrating its platform into multi-sensor fusion setups at mine locations thereby integrating with LiDAR GPS and others.

“We see our solutions complementing and integrating with other technologies,” Wood said. “We feel mines and other industrial sites should not have a ‘single point of failure’ within an automated setup as this can lead to unnecessary downtime, or – in some cases – potential accidents or injuries.”

A spike in GPS attacks, by “jamming” or “spoofing”, effectively means that depending completely on GPS is turning into a commer cially risky proposition for autonomous mine operators. “Terran360, and other examples of innovation developed by Navtech, aims to address these challenges,” Wood said.

The President and CEO of Epiroc, Helena Hedblom said, “Mining automation is increasingly important for the mining industry to strengthen safety and produc tivity, and RCT’s advanced solu tions complement Epiroc’s existing automation offering well.

In partnership with Oxbotica, an autonomous software expert, the Terran360 is certified to IP66 standard. The radar localization technology installed is protected from water and debris. This ensures constant operations with minimal maintenance to allow 100% visibility of assets at all times. “Oxbotica’s world-class localisation algorithms are com bined with Navtech’s ruggedised industrial radar sensors to provide a package that is resilient to weather and harsh environments,” Navtech added.

Oxbotica’s product portfolio in the mining industry includes software for the entire technological spectrum from low-level sensor managers to calibration, four-modal localization, mapping, perception, 3D map ping, and planning and control.

Navtech added, “In the mining and con struction industry, autonomous vehicles solely depend on GPS sensors to report their whereabouts. However, their ability to reliably maintain centimeter-level posi tioning required for autonomy, particularly within developments with tall infrastruc ture, deep pits, or at high latitudes, is often compromised.